Trade License

Trade License

What is Trade License?

If you plan to establish a business of your own and you have no idea where to start and what approval is needed, then the first thing you need to look is that –whether you want to deal in goods or services and secondly- what will be your place of business. After being clear about the above mentioned points, the next thing on your to-do list is getting a license.By the way of this license, the government regulates any specific business in a specific locality. The Municipal Corporation of the place grants permission or trade license to carry on a particular trade in a particular locality. It ensures adherence to relevant rules, standards and safety guidelines prevailing in the land.

Why it is different from Company Registration?

The registration of the business is important for giving it a legal identity of its own. It depends upon the promoter to decide upon the type of entity he wants to establish depending upon his business scale. However, it is mandatory for every entrepreneur to obtain the trade license before the commencement of any business activity. If any person is found conducting the business activity without obtaining the license, the business will be considered as illegal and heavy penalty may be levied upon the owner.When should License be Acquired?

Every business entity planning to start i'ts business operations shall be required to obtain this license within 15 days of the commencement of any activities. The activity consists of manufacture, exchange or even storage of any commodity. In some states it is mandatory to apply for this license 3 months prior to the commencement of any business activity.Who Regulates Trade License?

What are the minimum requirements for getting a license?

The Government has prescribed certain minimum requirements for obtaining online trade license in various states and cities. Some of the general conditions are as follow:- The individual applying for license must be atleast 18 years of age.

- The activities in which the business is going to get engaged shall be legal.

- The applicant shall be of clean image and shall be free from any criminal background.

Categories of Trade License

Type A Category

These licenses are issued for the business activities related to consumable items and eating hubs.Type B Category

These licenses are issued for such trades which makes use of locomotive power in order to function, such as industries, workshops, flour mills etc.Type C Category

These licenses are issued for trade involving dangerous activities such as firewood, charcoal etc.

What are the Documents Required?

From Trade License

- Utility Bill of the premises in which the business is going to be carried on.

- Rent Agreement, in case the premises is on rent/lease.

- Fire Department NOC.

- Municipal Tax Receipts.

- Registration Certificate under Shop and Establishment Act or Infrastructure development department etc.

- In case the premises is managed by any person other than the owner, then the photograph, ID proof and address proof of such manager.

- ID proof of the applicant.

- PAN card of the company, in case the applicant is a company.

- Copies of blueprint of the premise.

Online Trade License

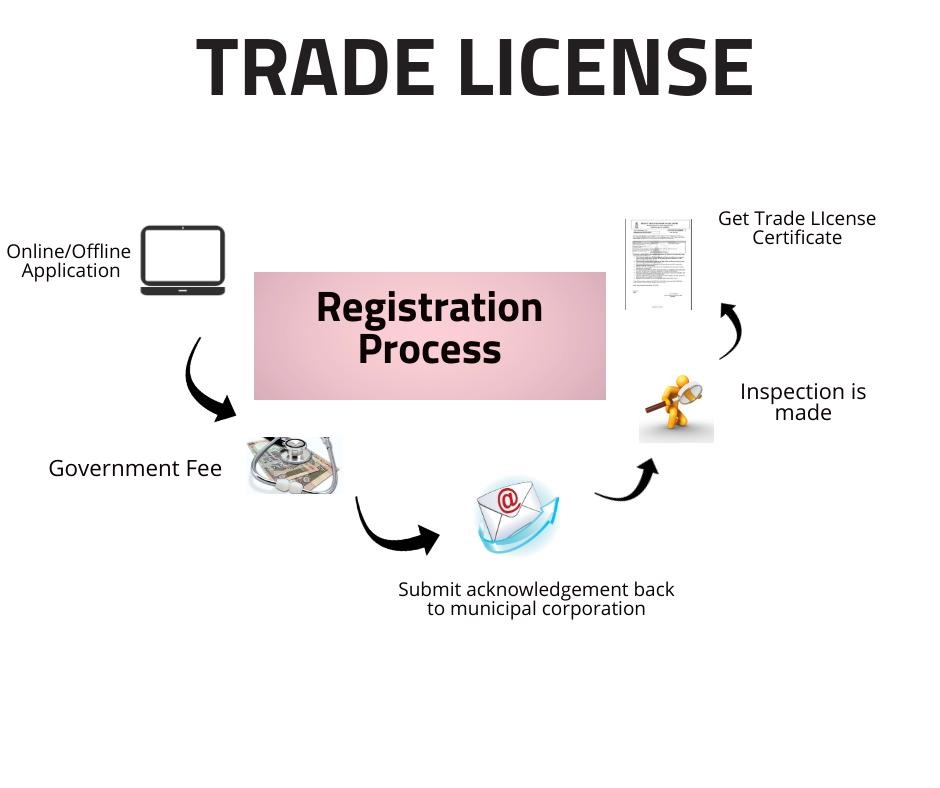

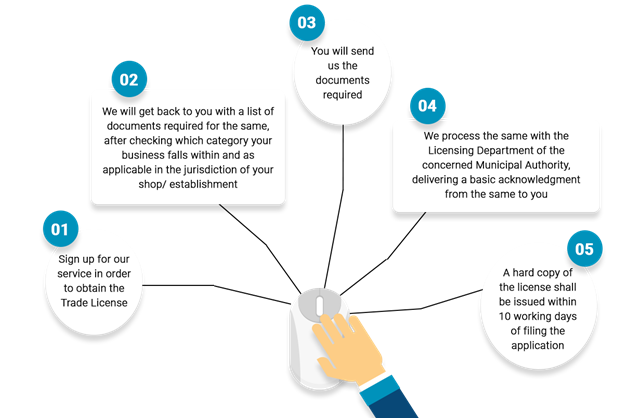

For obtaining Trade License, an online application can be filed with the authority by the professionals. For obtaining online trade license, documents are required to be submitted with the prescribed form. After this, trade license is granted by the authorities.Trade License Renewal

It is not a one-time license. It shall be renewed on periodical basis. The requirement of payment of annual fees for the continuity of the license is also mandatory in some states and cities. The trade license renewal is done from 1st January to 31st March of every year. The application for renewal shall be made atleast 30 days before the commencement of the year for which application is sought for. A fine of 50% of the license fees is levied in case of any delay in the trade license renewal process.

The following are the documents which are to be submitted with the application for trade license renewal:

- Copy of the Original License.

- Challans of the fees paid in the previous years.

- Tax Payment Receipt.

Appeal for Denial of Application

In case your application for online Trade License is denied on any grounds, then, you can file a petition to Standing Committee (Health) with a copy of letter of denial to consider the matter.What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex