Asset Reconstruction Company Registration

Asset Reconstruction Company Registration

What is Asset Reconstruction Company Registration?

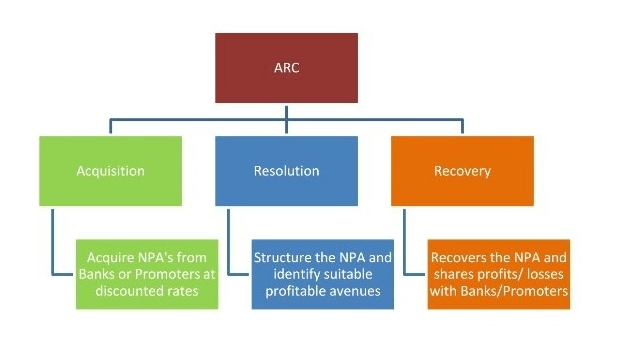

An Asset Reconstruction Company is a specialized financial institution which buys the Non-Performing Assets or bad assets from banks and financial institutions. In other words, we can say that ARCs are in the business of buying bad loans from banks. ARCs help to clean up the balance sheets of banks when the latter sells these to the ARCs. It helps banks to concentrate in normal banking activities. Banks rather than wasting their time and effort by going after the defaulters can sell the NPA’s to the ARCs at a mutually agreed value. Its primary goal is to manage and make profitable those assets which are underperforming or have formally classified as Non Performing Assets belonging to those companies which are unable to generate sufficient revenue to complete their outstanding obligations.

Under this, the main disadvantage is the potential loss of income which can be suffered in trying to resolve crises in distressed debt where companies are in danger of bankruptcy/insolvency. When ARC’s managed properly they have a significant possibility of profit if they can relieve the company under financial stress and manage to pass over the acquisition of the assets to other worthy candidates. For their services, they charge a management fee or commission from the distressed company/individual.

Under the SARFESI Act, the responsibility of the Asset management companies is to function as intermediaries between the promoter and the trust. Their main role is to see that the trust is able to take over the assets or loans at a nominal fee according to the revalued amount, which is consequently paid to the promoter for the acquisition.

In India the first ARC was a company named ARCIL which has been a leader in this field, having established industry standards for the rest of the market to follow.

Asset Reconstruction Company in India

In 1997 by Government of India, the problem of recovery from NPAs was recognized. In the Narasimhan Committee Report it is mentioned about the important aspect of the continuing reform process was to reduce the high level of NPAs as a means of banking sector reform. It was expected that new NPAs in the future could afford to be lower with the combination of policy and institutional development.- Isolating Non Performing Loans (NPLs) from the Financial System (FS),

- Freeing the financial system to focus on their core activities and

- Facilitating development of market for distressed assets.

Functions of Asset Reconstruction Company (ARC)

Following functions are performed by RBI as per RBI Notification:-

- Acquisition of financial assets (as defined u/s 2(L) of SRFAESI Act, 2002);

- Change or takeover of Management / Sale or Lease of Business of the Borrower;

- Rescheduling of Debts;

- Enforcement of Security Interest (as per section 13(4) of SRFAESI Act, 2002) Settlement of dues payable by the borrower.

Registration of Reconstruction Companies

No asset reconstruction company shall commence or carry on the business of asset reconstruction without- obtaining a certificate of registration

- having net owned fund of not less than two crore rupees or such other amount not exceeding fifteen per cent of total financial assets acquired or to be acquired by the securitization company or reconstruction company, as the Reserve Bank may, by notification, specify

- Every securitization company or reconstruction company shall make an application for registration to the Reserve Bank in such form and manner as it may specify.

- Reserve Bank of India may for the purpose of considering the application for registration of asset Reconstruction Company requires to be satisfied by inspection of records or books of such company.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex