Peer to Peer Lending License

Peer to Peer Lending License

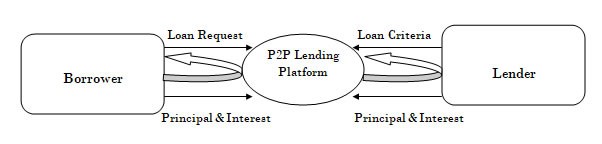

Peer to Peer (P2P) lending platform is basically an online platform to raise loans which are to be paid back with interest. The borrower may either be an individual or a legal entity. The online platform may set the interest rate to be charged on the loans or it may be decided mutually between the parties. P2P lending has been proved best for the startups & entrepreneurs to kick start their business as they need seed or venture funding. While if we talk about taking a loan from bank; it charges higher rate of interest. On this platform, entrepreneurs can easily borrow money from individuals.

In simple words, we can say that Peer to Peer (P2P) lending is a form of social lending under which individuals can lend or borrow money. There is no involvement of any financial institution, therefore, lenders are free to choose borrower. This concept of lending is gaining popularity among lenders as they get higher rate of interest.

What is Peer to Peer Lending License?

Peer to Peer lending is a method of debt financing under which individuals can lend or borrow money without the involvement of any financial institution as an intermediary. Peer to Peer lending companies is regulated by the Reserve Bank of India. They operate online involving low overhead cost. It is proving profitable for lenders as well as borrowers in such a way that lenders can earn higher rate of interest while borrowers can borrow at lower rate of interest.

For carrying out a P2P lending business, one has to obtain license from the Reserve Bank of India. For obtaining a P2P lending license, a proper application is filed with the authority along with the necessary documents by the expert professionals. Enterslice has a team of professionals who have expertise in this field, so if you’re interested in obtaining P2P lending license then you can contact us.

What are the characteristics of Peer to Peer Lending Platform?

P2P Lending model is revolutionizing the global financial market and reshaping the financial industry from past few years by introducing new innovative modules and lending services.Custom designed P2P lending platform is the best alternative in comparison to old-style exercise of borrowing money from banks as banks take long time to approve loans. Instead of approaching banks and applying for loans, P2P lending platforms can be used, where we only need to provide necessary information from sitting at home/ office and within hours our loan will be processed and approved.

Here are the following characteristics of Peer-to-Peer Lending

- P2P Lending platform involves online transactions;

- Prior relationship between lenders and borrowers is not necessary;

- On P2P platform, lenders can freely choose borrowers to invest in;

- No direct intermediary negotiating interest rates or amounts.

What are the pros & cons of Peer to Peer Lending Platform?

For Borrowers

Pros:

- Low-Interest Rates: The borrowers can avail the benefits of low interest rates as compared to banks and credit cards. In some cases reduction of about 35% has been witnessed.

- Fixed Rate of Interest: This type of platform provides the leverage of fixed rate of interest even in the case of late payments, thereby, it acts as a lucrative option in the hands of the borrower.

- Simple and Fast Processing of Application: the customers are provided with exclusive digital experience of facilitating rapid flow of transactions.

- Lower Fees: the platform charges lower fees as compared to other modes of finances. Moreover, no penalty is attracted to pre-payment.

- In comparison to banks, it involves low amount of loan.

- Less Security

- Sometimes borrowers are more than lenders

- Higher Returns: Generally,the returns offered to the investors are higher, depending upon the type of risk you undertake.

- Diversification: Forinvestors, there is a wide variety of options available to put their capital into.

- Direct Communication with the Buyer: the platform provides the lenders an option to directly communicate with borrowers and finalizes their deal with the borrowers.

- Whether the credit rating assessment done by the platform is reliable or not, is a concern. Therefore the risk associated is not certain.

- With the P2P industry still in its nascent stage, it would be too early to reach a definitive conclusion.

- Returns are lower in comparison to publicly traded index fund

Regulatory Framework of Peer to Peer Lending Platform

While most of the crowd-funding- be it, equity, debt or fund based, fall under the purview of the capital market regulator-SEBI, the P2P lending is regulated by Reserve Bank of India. Different jurisdictions of the world treat P2P lending differently. In some countries, they are identified as banks while in other countries, they are treated as intermediaries. This drags us into understanding the global scenario circumventing the P2P lending across the world.

While most of the crowd-funding- be it, equity, debt or fund based, fall under the purview of the capital market regulator-SEBI, the P2P lending is regulated by Reserve Bank of India. Different jurisdictions of the world treat P2P lending differently. In some countries, they are identified as banks while in other countries, they are treated as intermediaries. This drags us into understanding the global scenario circumventing the P2P lending across the world.

| Regulatory Regime | Description | Countries Currently Using the Regime |

| Exempt market/ Unregulated through lack of definition | In these jurisdictions, either the regulation has classified P2P lending as an exempt market or there is a lack of definition in legislation. However, in some cases, there is regulation designed to protect borrowers and that mainly involves rules already in place to protect the borrower from unfair interest rates, unfair credit provision and false advertising. | China, Ecuador, Egypt, South Korea, Tunisia |

| Intermediary Regulation | This regulates P2P lending platforms as an intermediary. It usually requires registration as an intermediary, and other regulatory requirements depending on the jurisdiction. Generally, there are regulations that establish the prerequisites for the platforms to register in order to access the market. Other rules and requirements determine how the platform should conduct its business (for example, the licensing needed to provide credit and/or financial services). | Australia, Argentina, Canada (Ontario), New Zealand, United Kingdom |

| Banking Regulation | This regulates P2P lending platforms as banks due to their credit intermediation functions and is therefore regulated as banks. As such, the platforms must obtain a banking licence; fulfil disclosure requirements and other such regulations. | France, Germany, Italy |

| US Model | There are two levels of regulation, Federal regulation through the Securities and Exchange Commission (SEC) and State level, where platforms have to apply on a state-by-state basis. One level below the federal requirements is state regulation. Some states outright ban the practice of P2P lending (e.g. Texas). Other states place limits on the type of investors using the platforms to lend (e.g. California). In addition, if a platform wishes to operate across multiple state boundaries, it must apply to each state separately. | United States of America |

| Prohibited | P2P lending is banned under legislation. | Israel, Japan |

Peer to Peer Lending in India

The online market for loans and investments is growing at a rapid speed, so it is important to make a way for a wide cadre of investors and fund seekers to meet at a common platform for the satisfaction of their financial motives. Although Peer to Peer Lending (P2P) is in its infant stage in India and the risk associated with the P2P lending in the financial market is too prominent to be ignored.There is a one factor which has enhanced the rise of Peer to Peer lending industry in India, i.e, during 2016-2017 slowdown in lending by the banks. This slowdown forced to seek other methods of lending in industry. As per the sources it has been predicted that by the year 2023, this industry will grow into a $ 5 billion. Presently there are more than 30 players in market like Faircent, Lentbox, Capital Float, Indifi, IndiaMoneyMart, Monexo, Rupaiya Exchange, Capzest LoanBaba, i2iFunding etc..

To regulate P2P lending platforms, RBI releases guidelines so that they can grow in a structured, fair and regulated manner. Last year RBI also notified that Peer to Peer lending platforms would be treated as Non Banking Financial Companies (NBFC). RBI issues guidelines time to time in order to safeguard the interest of all lending platforms and lenders as well as borrowers. It has been also predicted by the experts that soon P2P lending portals will be able to access credit data.

Peer to Peer Lending in Global Scenario

In countries such as Israel and Japan, the P2P lending is completely prohibited. Certain countries such as Australia, Canada, UK treat them as the financial intermediaries..

In China, Egypt, South Korea, P2P lending is not regulated and is considered as the exempt market due to the lack of definition.

The P2P lending is treated under the Banking Regulation in the countries such as France, Germany, and Italy..

In the United States, the concerned is treated in the dual phase-one at the central level and other at the state level.

Scope of Activities

The P2P lending platforms are the Fintech Companies registered under the Companies Act. They help in creating the match between lenders and borrowers. After registering the borrower within itself, the platforms perform the task of their credit assessment. Only those candidates, who fulfill the due diligence test with the platform are allowed to take part in the borrowing and lending process. The platforms also provide certain additional services such as credit assessment, risk analysis, recovery etc. Even the documentation for the lending and borrowing is facilitated by the online portal. Following are the scope of activities:- Act as an intermediary

- P2P lending platform is not permitted to lend on its own

- Not permitted to arrange credit enhancement/guarantee

- P2P lending platform do not possess the power to permit any secured lending

- Any other financial product cannot be sold

- International flow of funds cannot be permitted

- It is mandatory to adhere all applicable legal norms

What is the funding process under Peer to Peer Lending?

- P2P funding via auction

- Via a fixed rate auction

- The marketplace P2P lending model

What are the types of Peer to Peer Lending Model?

Now let’s discuss the classification of Peer to Peer Lending model into following types of lending:

- Consumer Lending

- Small Business (SME) Lending

- Working capital

- Business expansion, and

- Asset finance

- Property Lending

How does Peer to Peer Lending platform works?

On peer-to-peer lending platform, loans are taken by the borrowers from the individual investors (lenders) who are willing to lend their money to the borrowers on an agreed rate of interest.On P2P lending platform, the profiles of the borrowers are displayed, from where lenders can freely choose the borrowers’ profile and take decision of lending money. It is not necessary to have any relationship between lender and buyer.

It is not necessary that proposed borrower receive full loan amount, he may get certain amount of what he asked for from an investor. For the remaining amount, the loan may be given by one or more investors on the P2P lending platform.

How Peer to Peer Lending is different from banks?

Usually, individuals or business entities who want to take loan, apply for it from banks. In turn, a bank takes a long time in verification of extensive financial background. This is done by the banks to determine the credit score of applicants and the loan history. On the basis of verification, banks take decision whether the proposed borrower is qualified for a loan. In comparison of banks, Peer to Peer lending platform involves faster processing of loan as there is no intermediary.

Usually, individuals or business entities who want to take loan, apply for it from banks. In turn, a bank takes a long time in verification of extensive financial background. This is done by the banks to determine the credit score of applicants and the loan history. On the basis of verification, banks take decision whether the proposed borrower is qualified for a loan. In comparison of banks, Peer to Peer lending platform involves faster processing of loan as there is no intermediary.

| Basis | Bank | Peer to Peer Lending Platform |

| Duration | Banks takes longer time to sanction a loan due to in depth verification of applicant's financial background | Faster Processing of Loan as there are less stringent rules |

| Product | Standardized lending products are offered to its customers | A customized solution is provided to customers on the basis of their profile |

| Approach | Closer look of credit score | A data-driven approach is used for lending |

| Rules & Regulations | Stringent rules and regulations as there is an involvement of proper credit rating assessment | Flexible rules & regulations therefore risk associated with P2P is not certain |

| Loan Amount | Loan amount can be higher | Limitation on the loan amount (Maximum Rs. 10 lakhs/-) |

What are the basic requirements for obtaining Peer to Peer Lending License?

The P2P Lending platforms come under the purview of Reserve Bank of India taking the definition of NBFCs under section 45I(f)(iii) of the RBI Act.

The P2P Lending platforms come under the purview of Reserve Bank of India taking the definition of NBFCs under section 45I(f)(iii) of the RBI Act.

The various pillars governing the regulatory framework are:

- Permitted Activity: The P2P platforms can be registered as an intermediary, as their role is to bring the lender and borrower together without reflecting the lending and borrowing in its Balance Sheet. The leverage to provide any assured return shall be prohibited. The funds shall be directly transferred into the Borrower’s account from the Lender’s account to escape the threat of money laundering. The FEMA guidelines shall also be considered in the case of any cross-border transactions.

- Prudential Requirements:A minimum capital of INR 2 crore is required.

- Governance Requirements:It includes fit and proper criteria for promoters, directors, and CEO. The Board must also consist of a reasonable portion of members having a financial background. A physical place of business is also required to be established in India, with the management primarily based in the country.

- Business Continuity Plan: Adequate risk management policy shall be put in place by the platform acting as the custodian of cheques and agreements.

- Customer Interface:Since the platform uses the data of the customers to assess their credibility, it is the duty of the portal to safeguard their information in the first place. Their operations shall be transparent, the data confidentiality shall be maintained. There shall be no false promises regarding extraordinary returns.

- Reporting Requirements:These online entities are required to submit regular reports based on their financial position, loans arranged in each quarter, complaints received in each quarter etc. to the Reserve Bank of India.

- Loan Amount - Loan amount to one borrower cannot exceed more than INR 1 Million.

Who is eligible to apply for Peer to Peer lending License?

Following below mentioned are eligible to apply for Peer to Peer Lending License in India:

- A company registered in India;

- Applicant must possess technological, entrepreneurial and managerial resources;

- In order to carry out P2P lending platform, an applicant must have adequate capital structure;

- Proposed Directors must fulfill the fit and proper criteria

- There must be a proper plan for efficient Information Technology System

- A viable Business Plan

- Motive to serve in public interest

What is the procedure of obtaining Peer to Peer Lending License?

Any entity desirous of commencing the business of P2P lending and registered as a Private Limited Company or Public Limited Company can apply to RBI for the P2P license. For this, they have to fulfill the following:- Company should be registered in India as Private Limited Company or Public Limited Company with the principal objective of financing;

- Minimum net owned funds of INR 2 crores.

- Website / Mobile App Work Flow

- The online application is available on RBI's website (COSMOS).

- Submission of hard copy of the application along with attached documents shall be submitted to RBI Office.

- The license will be granted only after vigilant inspection of the application and documents attached with it.

Peer to Peer and Crowd Funding

In India, Peer to Peer lending is a form of crowd-funding under which loans are raised and paid back with interest. P2P lending platform is an online platform on which lenders and borrowers register themselves to raise unsecured loans. Under this, borrower can either be an individual or a legal entity.Minimize Risk and Maximize Returns on the Peer to Peer Lending platform

In P2P Lending, borrowers are being provided with the low rate of interest than those offered by the other money lenders in an unorganized sector. Under this, lenders earn higher returns than what traditional investment opportunities offer. Interest rates charged on the loans vary from one platform to other ranging from a flat interest rate fixed by the platform to dynamic interest rates as agreed upon by the borrowers and the lenders. Ways to get benefit of returns:- To get the benefit of higher returns, diversify investments.

- To benefit from the power of compounding, regularly reinvest payments.

- To minimize default, divide overall investment and lend to multiple borrowers within the same category.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex