Business Plan Consultant

Business Plan Consultant

Business Plan

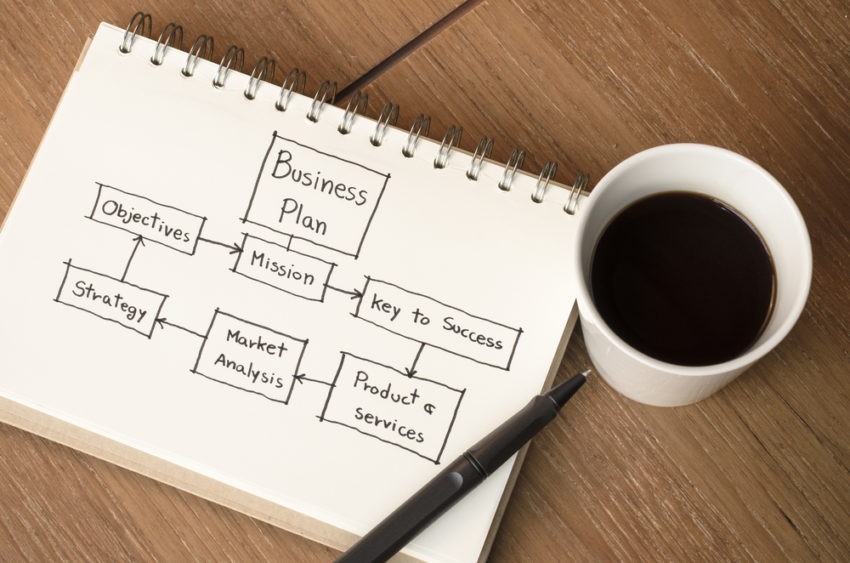

A business plan is a written expression of the entrepreneurial vision. A business plan is a vital document for any business that contains information about the pertaining to its promoters, business model, operations, past, competitor analysis, market analysis and project financial performance. A good business plan serves as a roadmap for the firm and provides information in a systematic format to investors, founders and financial advisors. The purpose of a business plan or investor pitch is for fundraisings like equity capital or angel investment.

If you are looking for funding then it will be crucial to go along with an actual business plan consultant because they won’t help you on the basis of what you have in your mind, rather they will help you in preparing a Business Plan which will attract the investors. We SSRA, have team of professional with extensive experience in preparing business plans. Contact us today and we can help you prepare a well-structured business plan for your startup.

Before you blindfolded choose any business plan consultant, it’s imperative to know why business plan consultant is necessary for any business or why you need them. Some of the greatest reasons are as follows:

- At the beginning of the financial year

- A new fiscal period is about to begin. You may forecast your business plan annually, quarterly or even monthly if your industry is dynamic.

- For SEED / Venture Funding

- When you approach VS or angel investor the first question that they are going to ask if you have a business plan to help them make financing decisions.

- Market Change

- When you are in a dynamic market, you see Shifting client tastes, consolidation trends among customers and altered regulatory climates can trigger a need for a business plan consultant.

- Launching a New Product

- Your firm is planning to launch a new product or develops a new product, technology, service i.e. business plan consultant needed.

- Change in Management If there is substantial change in the top or middle management, new managers should get fresh information about your business and your goals.

Understanding

Prior to preparing the business plan, our Financial Experts will work with you to understand your business, proposed plans and capital requirement.Business Plan Preparation

Based on our understanding of your startup business and the information collected, our Financial Experts will draft a business plan for your startup.Business Plan Finalization

Once the draft business plan is prepared, you can provided your comments or inputs to finalize and prepare the final business plan and investor pitch.

1. Executive Summary

Your executive summary should appear first in your business plan. It should summarize what you expect your business to accomplish. Since it’s meant to highlight what you intend to discuss in the rest of the plan, the Small Business Administration suggests that you write this section last.

A good executive summary is compelling. It reveals the company’s mission statement, along with a short description of its products and services. It might also be a good idea to briefly explain why you’re starting your company and include details about your experience in the industry you’re entering.

2. Company Description

The next section that should appear in your business plan is a company description. It’s best to include key information about your business, your goals and the customers you plan to serve.

Your company description should also discuss how your business will stand out from others in the industry and how the products and services you’re providing will be helpful to your target audience.

3. Market Analysis

Ideally, your market analysis will show that you know the ins and outs of the industry and the specific market you’re planning to enter. In that section, you’ll need to use data and statistics to talk about where the market has been, where it’s expected to go and how your company will fit into it. In addition, you’ll have to provide details about the consumers you’ll be marketing to, such as their income levels.

4. Competitive Analysis

A good business plan will present a clear comparison of your business to your direct and indirect competitors. You’ll need to show that you know their strengths and weaknesses and you know how your business will stack up. If there are any issues that could prevent you from jumping into the market, like high upfront costs, it’s best to say so. This information will go in your market analysis section.

A good business plan will present a clear comparison of your business to your direct and indirect competitors. You’ll need to show that you know their strengths and weaknesses and you know how your business will stack up. If there are any issues that could prevent you from jumping into the market, like high upfront costs, it’s best to say so. This information will go in your market analysis section.

5. Description of Management and Organization

Following your market analysis, your business plan will outline the way that your organization will be set up. You’ll introduce your company managers and summarize their skills and primary job responsibilities. If you want to, you can create a diagram that maps out your chain of command.

Don’t forget to indicate whether your business will operate as a partnership, a sole proprietorship or a business with a different ownership structure. If you have a board of directors, you’ll need to identify the members.

6. Breakdown of Your Products and Services

If you didn’t incorporate enough facts about your products and services into your company description (since that section is meant to be an overview), it might be a good idea to include extra information about them in a separate section. Whoever’s reading this portion of your business plan should know exactly what you’re planning to create and sell, how long your products are supposed to last and how they’ll meet an existing need.

It’s a good idea to mention your suppliers, too. If you know how much it’ll cost to make your products and how much money you’re hoping to bring in, those are great details to add. You’ll need to list anything related to patents and copyright concerns as well.

7. Marketing Plan

In your business plan, it’s important to describe how you intend to get your products and services in front of potential clients. That’s what marketing is all about. As you pinpoint the steps you’re going to take to promote your products, you’ll need to mention the budget you’ll need to implement your strategies.8. Sales Strategy

How will you sell the products you’re building? That’s the most important question you’ll answer when you discuss your sales strategy. It’s best to be as specific as possible. It’s a good idea to throw in the number of sales reps you’re planning to hire and how you’ll go about finding them and bringing them on board. You can also include sales targets.9. Request for Funding

If you need funding, you can devote an entire section to talking about the amount of money you need and how you plan to use the capital you’re trying to raise. If you’ll need extra cash in a year or two to complete a certain project, that’s something that’s important to disclose.10. Financial Projections

In the final section of your business plan, you’ll reveal the financial goals and expectations that you’ve set based on market research. You’ll report your anticipated revenue for the first 12 months and your annual projected earnings for the second, third, fourth and fifth years of business.

If you’re trying to apply for a personal loan or a small business loan, you can always add an appendix or another section that provides additional financial or background information.

7 Elements of a Business Plan

Your well-thought-out business plan lets others know you’re serious, and that you can handle all that running a business entails. It can also give you a solid roadmap to help you navigate the tricky waters. The seven components you must have in your business plan include:

Your well-thought-out business plan lets others know you’re serious, and that you can handle all that running a business entails. It can also give you a solid roadmap to help you navigate the tricky waters. The seven components you must have in your business plan include:

- Executive Summary

- Business Description

- Market Analysis

- Organization Management

- Sales Strategies

- Funding Requirements

- Financial Projections

1. Executive Summary

The executive summary is basically the elevator pitch for your business. It distills all the important information about your business plan into a relatively short space. It’s a high-level look at everything and should include information that summarizes the other sections of your plan.

One of the best ways to approach writing the executive summary is to finish it last so you can include the important ideas from other sections.

Coffee House, Inc.’s executive summary focuses on the value proposition of the business. Here’s what they’ve written into their plan:

“Market research indicates that an increasing number of consumers in our city are interested in the experience of coffee. However, there isn’t a viable place for them to meet and learn locally. Instead, they only have access to fast coffee. Coffee House, Inc., provides a place for people to enjoy fresh-ground beans and truly enjoy their cup.

“Coffee House, Inc., provides a hub for a subculture of coffee, offering customers a place to purchase their own coffee-grinding supplies in addition to enjoying the modern atmosphere of a coffee house.

“The founders of Coffee House, Inc., are coffee aficionados with experience in the coffee industry and connections to sustainable growing operations. With the experience and expertise of the Coffee House team, a missing niche in town can be fulfilled.”

2. Business Description

This is your chance to describe your company and what it does. Include a look at when the business was formed, and your mission statement. These are the things that tell your story and allow others to connect to you. It can also serve as your own reminder of why you got started in the first place. Turn to this section for motivation if you find yourself losing steam.

Some of the other questions you can answer in the business description section of your plan include:

- What is the business model? (What are your customer base, revenue sources and products?)

- Do you have special business relationships that offer you an advantage?

- Where are you located?

- Who are the principals?

- What is the legal structure?

- What are some of the market opportunities?

- What is your projected growth?

3. Market Analysis

This is your chance to look at your competition and the state of the market as a whole. Your market analysis is an exercise in seeing where you fit in the market — and how you are superior to the competition.

As you create your market analysis, you need to make sure to include information on your core target market, profiles of your ideal customers and other market research. You can also include testimonials if you have them.

Part of your market analysis should come from looking at the trends in your area and industry. Coffee House, Inc., recognizes that there is a wide trend toward “slow” food and the idea of experiencing life. On top of that, Coffee House surveyed its city and found no local coffee houses that offered fresh-ground beans or high-end accessories for do-it-yourselfers.

Coffee House can create an ideal customer identity. The ideal customer is a millennial or younger member of Gen X. He or she is a professional and interested in experiencing life and enjoying pleasures. The ideal customer probably isn’t wealthy, but is middle class, and has enough disposable income to have a hobby like coffee. Coffee House appeals to professionals who work (and maybe live) in a downtown area. They meet their friends for a good cup of coffee, but also want the ability to make good coffee at home.

4. Organization and Management

Use this section of your business plan to show off your team superstars. In fact, there are plenty of indications that your management team matters more than your product idea or pitch.

Venture capitalists want to know you have a competent team that has the grit to stick it out. You are more likely to be successful and pivot if needed when you have the right management and organization for your company.

Make sure you highlight the expertise and qualifications of each member of the team in your business plan. You want to impress.

In the case of Coffee House, Inc., the founders emphasize their connections in the world of coffee, particularly growers that use sustainable practices. They can get good prices for bulk beans that they can brand with their own label. The founders also have experience in making and understanding coffee and the business. One of them has an MBA, and can leverage the executive ability. Both have worked in marketing departments in the past, and have social media experience, so they can highlight their expertise.

5. Sales Strategies

How will you raise money with your business and make profits a reality? You answer this question with your sales strategy. This section is all about explaining your price strategy and describing the relationship between your price point and everything else at the company.

You should also detail the promotional strategies you’re using now, along with strategies you hope to implement later. This includes your social media efforts and how you use press releases and other appearances to help raise your brand awareness and encourage people to buy or sign up for your products or services.

Your sales strategy section should include information on your web development efforts and your search engine optimization plan. You want to show that you’ve thought about this, and you’re ready to implement a plan to ramp up sales.

Coffee House needs to make sure they utilize word of mouth and geolocation strategies for their marketing. Social media is a good start, including making Facebook Live videos of them demonstrating products and how to grind beans. They can encourage customers to check in when visiting, as well as offer special coupons and promotions that activate when they come to the house to encourage sales.

6. Funding Requirements

Here’s where you ask for the amount of money you need. Make sure you are being as realistic as possible. You can create a range of numbers if you don’t want to try to pinpoint an exact number. Include information for a best-case scenario and a worst-case scenario. You should also put together a timeline so your potential funders have an idea of what to expect.

It can cost between $200,000 and $500,000 to open a coffee house, and profit margins can be between 7 and 25 percent, depending on costs. A well-run coffee house can see revenues of as much as $1 million a year by the third year, according to the Chronicle. Some of the things Coffee House, Inc., would include in its timeline are getting premises, food handlers’ permits and the proper licenses, arrange for regular supply and get the right insurance. How long these items take depend on state and local regulations. No matter your business, get an idea of what steps you need to take to make it happen and how long they typically take. Add it all into your timeline.

7. Financial Projections

Finally, the last section of your business plan should include financial projections. Make sure you summarize any successes up to this point. This is especially important if you hope to secure funds for expansion of your existing business.

Your forward-looking projections should be based on information about your revenue growth and market trends. You want to be able to use information about what’s happening, combined with your sales strategies, to create realistic projections that let others know when they can expect to see returns.

Even though it can be time-consuming to create a business plan, your efforts will be rewarded. The process is valuable for helping you identify potential problems, as well as help you plan ahead. You’ll be more organized and better prepared for success.

- Detail the market need or pain: All great companies solve a real customer need or pain. You must detail what this need is, how big it is, and whether it is growing or shrinking.

- Detail both your direct and indirect competition.If there is a real customer need or pain, customers must be trying to solve it already. In your plan, you must detail how they are solving the need currently. For example, when eBay first launched, it realized that the need for selling personal products was being met by yard or garage sales (indirect competition). This proved that there was a market need or pain.

- Create a credible financial model.Creating a financial model that shows that your company will take off like a rocket ship will do more harm than good. Investors and lenders know how a company might grow after they fund them. They know that growth takes time, even in a best case scenario.

In developing your financial model, you should really think through the timing of your growth. How long will it take to hire and train the right employees? How long will it take to repeatedly get your marketing message in front of customers until they buy? Etc. These things generally take longer than you initially think. And during this time, you are often incurring expenses and generating less revenues than projected. Which often results in companies running out of money.

So, be careful to consider slower growth scenarios so you don’t run out of cash.

The right business plan will get investors and lenders excited to write you a check that allows you to dramatically grow your company. And the right plan will keep you and your team motivated and on track to achieve your long-term objectives. So, don’t treat your plan as a necessary evil. Rather, treat it as an investment that can give you a significant ROI.

What Goes Into the Funding Request

This section of your business plan should cover the following:An Outline of The Business

Yes, you've done this already in past sections, but you want to give potential lenders and investors a recap of your business. In some cases, you might simply share the Funding Request Section so you need to have your business details such as what you provide, information about your target market, your structure (i.e. LLC), owners and members information (for partnerships and corporations), and any successes you've had to date in your business.Current Financial Situation

Again, you've provided some financial information in the Financial Data section, but it doesn't hurt to summarize. If you're submitting just the funding request, you'll need this information to help financial sources understand your money situation. Provide financial details such as income and cash flow statements, and balance sheets. Offer your projected financial information as well. If you're asking for a loan for which you'll be offering collateral, include information about the asset as well.

If the business had debt, outline your plan for paying it off. Finally, share how you'll pay the loan or what sort of return on investment (ROI) investors can expect by investing in your business.

How Much Money Do You Need Now and in the Future?

Indicate what type of funding you're asking for such as a loan or investment. Outline what you need now and what you might need in the future (as far as five years out).How Funds Will Be Used?

Detail how you'll be using the money, whether it's for inventory, paying a debt, buying equipment, hiring help, etc. If you plan to use the money for several things, highlight each and how much will go to each. Note that most financial sources would rather invest in things that grow a thriving business than to pay for debt or overhead expenses.Current and Future Financial Plans

Current and future financial plans such as loan repayment schedule or plans to sell the business. If you're getting a loan, outline your plans for repayment (although most lenders will have their own schedules). If you have plans to sell the business, let the lender know that and how it will affect them. Other issues to consider are relocation (if you move) or a buyout. Finally, let investors know how they can exit the deal, such as cashing out (how long before they can do that?).Important Points to Remember in Writing Your Funding Request

You're asking for money, so you need to always be professional and know your business inside and out. Here are some other things to keep in mind:- Tailor your funding request to each financial source. Lenders and investors need different information (i.e. loan repayment versus ROI), so create different reports for each.

- Keep your funding sources in mind. Each resource will have different questions and concerns. Do a little research so you can address them in your report.

- Ask for enough to keep your business going. Don't be stingy, as you don't want your business to fail from a lack of money. At the same time, don't be greedy, asking for more than you need.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex