GST Registration Services

GST Registration Services

GST Registration- Meaning, Benefits, Eligibility, & Penalty

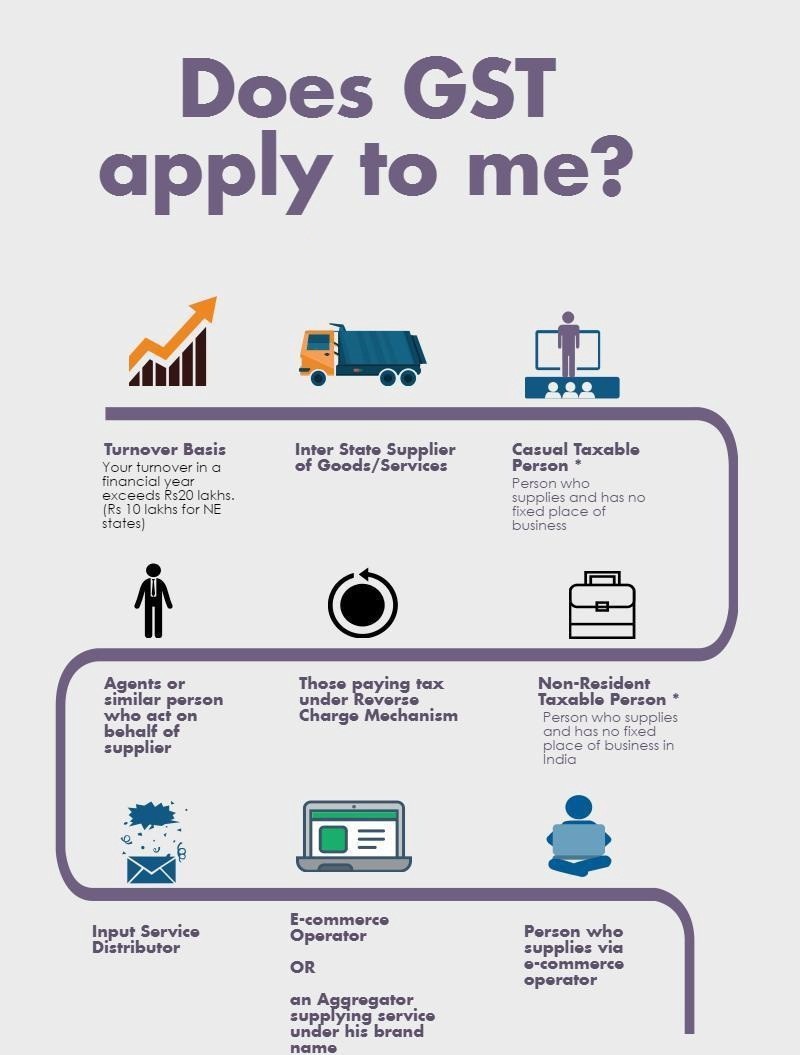

GST (Goods and Service Tax) registration in India is the most significant tax reform. It is the initiative of government to improve the ease of doing business in India.The GST registration reform not only regulated the unorganized sectors of economy but also encouraged the flow of foreign investments in India.Under the GST regime, a business whose estimated annual turnover exceeds Rs. 40 Lakhs (Rs 20 Lakhs for Northeast states) is required to register as a regular taxpayer. GST registration application is mandatory for a particular businesses like Export-Import, E-commerce, Casual Dealer,and Market Place Aggregator.Such business units need a GSTIN irrespective of the annual business turnover.

If a GST applicable Business unit supplies goods or services without GST registration number, then it is considered as an offense. Such offense attracts a liability to pay heavy penalty under the GST Act.

GST Registration usually takes 3-6 Working days. The Enterslice team can help you in getting new GST Registration in 5 easy steps.

Who must to Apply for GST Registration Number?

- Individuals who were filing tax under the Pre-GST laws such as Vat, Service Tax, etc.

- Businesses with turnover above the prescribed limit of Rs. 40 Lakhs*

- People involved in Distribution and Supply to manufacturers

- People seeking Tax Refund under double taxation mechanism

- Manufacturer of Goods

- People providing materials through e-commerce aggregator

- Every kind of e-commerce aggregator

What are the benefits of a new GST Registration?

- Pan India Business operations

- Relief from the double taxation system

- Higher threshold for GST Registration

- Eligible for acquiring government tenders

- Business expansion possibilities with International Companies

- Opportunity to avail input tax credit on purchases

- Lower tax rates under composition scheme (For Annual turnover up to Rs 1.5 Cr)

- Easy and online return filing

- Improved logistics by Introduction of E-way Bill

- Reduction of Compliance Costs

What is GST Registration Online Process?

The GST registration online process step by step involves online submission of forms with the help of subject matter experts. These simple steps help you to learn how to apply GST online.

Official GST Registration Procedure

The GST registration online process step by step involves online submission of forms with the help of subject matter experts. These simple steps help you to learn how to apply GST online.

Official GST Registration Procedure

- Create a user id on GST Portal. (https://www.gst.gov.in/)

- Fill the Part A of GST Registration Form-1

- A reference number will be provided via registered mobile number and email id

- Fill up the 2nd Form of GST registration process and upload the required documents

- A Certificate of GST Registration will be issued after the completion of the registration procedure

How Enterslice will help you to get GST Registration?

Enterslice is the top rated GST Registration service provider in India. We deliver GSTIN within 3 to 6 working days. Enterslice GST Experts will guide on applicability, registration & will help you in meeting Compliance prescribed under the GST Act.- Purchase a plan for GST Registration Starting from Rs 1,499/-

- A CA is assigned on your order

- Upload documents via mobile or website

- Our Expert will submit documents after in-depth scrutiny of documents

- ARN No Generation – After Filing on GST Port ARN shall be shared with you for future references

- GSTIN issued – GST Department will issue a certificate in 2-3 Working days

- Pan Card of the Applicant taxpayer

- Identity proof and address proofs of all the promoters of the business

- Photographs of Directors / Partners / Owners

- Proof of registration of business, or Partnership Deed in case of partnership and registration certificates

- Address proof for the location of a business.

- Bank account details of the business.

- Digital Signature

- Letter of Authorization from Partners / Board of Directors

New GST Registration Fees

The process of new GST registration involves various steps and documentation. There is a option to select the SAC/HSN code at the time of registration. This process requires sound knowledge of the GST laws. Thus, it is recommended to take Professional help for the same. Our team at Enterslice provides end to end service for GST registration. Our GST Registration fees start from Rs 1499 onwards.

GST Return Filing Dates

The business entity will require filing the GST returns on due dates after obtaining online GST Registration. The requirement of GST Returns is based on the annual turnover of a taxable person.- Penalties for Not Registering under GST

- There are strict laws under the GST Act for non-compliance of the GST regulations.

- Penalty for not filing for a GST identification number

- Any offender not paying his due tax is liable to pay a penalty of 10% of the tax amount. This amount must not be less than Rs 10,000.

- In case of short payment of tax, a minimum penalty of Rs 10,000 has to be paid. The maximum amount can be the amount equivalent to 10% of the unpaid tax.

- Penalty for non-filing of GST Returns on due date

- In case of non filling of unpaid Tax, there is a penalty of Rs 50 per day. The maximum amount must not exceed 5000 rs.

- There is also provision of penalty by jail term for offenders with the intention to commit fraud.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex