Accounts payable services

Accounts payable services

What are Accounts Payable Outsourcing services?

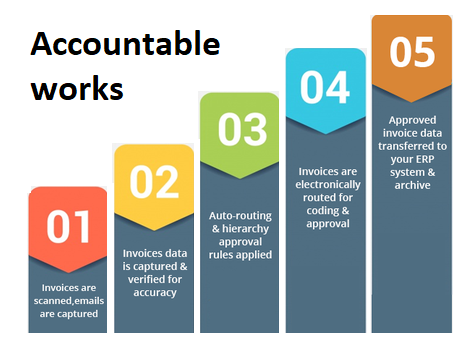

Handling a large number of invoices and other accounts payable documentation in a row is a very hectic task for the company. This task also has become extremely time consuming and costly for the Accounts payable department. The accounts payable outsourcing service helps in streamline the multiple tasks, including scanning, matching, validation, and approval. It also enables staff to concentrate on core business tasks, generating faster processing times and quick payments.Why proper Invoice Indexing and per-defined Workflow is required for Accounts Payables Processing?

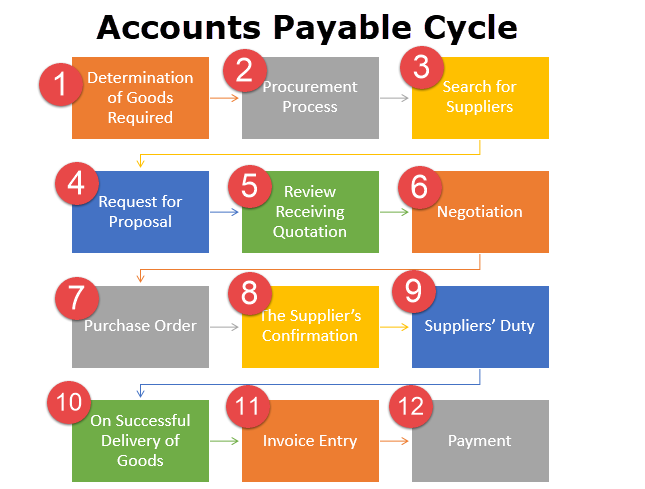

Digitizing your invoices and creating a workflow can help the business to organize the flow of vendor invoices through various approval and quality check process very easily. It also ensures the same by suggesting small technical changes in the existing system and creates a workflow with required control points for accuracy and timeliness of the payable cycle.What do we do in Invoice Indexing?

We index your PO and Non-PO invoices/expenses to go through the required approval authority. The workflow allows us to get a complete MIS for visibility of invoice status in real time and also maintain all your geographies.Why is proper Invoice Processing required?

Suppliers play an important role in the growth of the organization by giving their payments on time which also helps in strengthening the relationship. An invoice correctly processed leads to hassle-free clearance of payable and take discounts on early payments as well.

What do we do in Invoice Processing?

Our team of professionals has extensive knowledge of the Accounts Payable process that handles all kind of invoices i.e. PO based Invoice, Non-PO Invoices, Service or Material Invoice, Work Orders with a high level of accuracy on applicable taxes, helping your business to update payable in a timely manner.What is the importance of Payment Processing in Accounts Payable Processing?

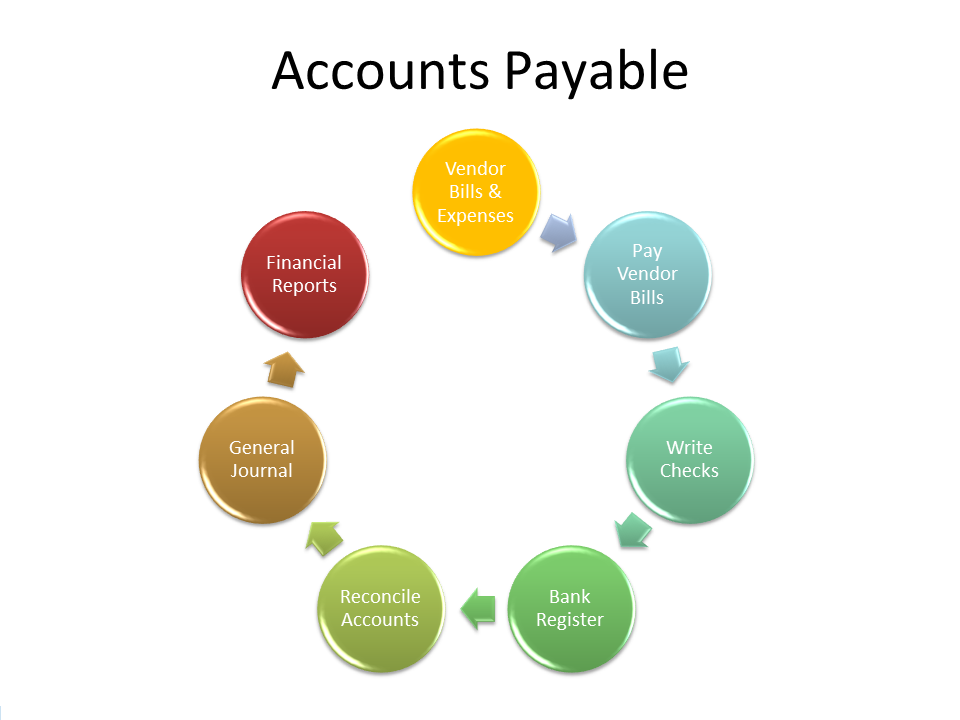

Credit period is an important aspect to manage by the organization as it directly affects the cash flow in the business. On one hand, paying early gives additional discounts thus saving money for the business and on the other hand paying on due dates allows the business to enjoy complete credit period and maintain working capital available all the time.Why should we prefer for GRIR Reconciliation before making payments to the vendor?

Have you wondered why your team takes a lot of time at the end of the year correcting the ledgers for nominal accounts, or any suspense account? Your inventory and payables need to be reconciled regularly so that your books are up-to-date and show true status of your ledgers. Let us help you in the best possible way.What do we do in GRIR Reconciliation?

We reconcile at the unit level of Purchase Order receiving with the invoices being sent by the vendors and report/clear any variation at frequent intervals. We coordinate with the procurement and the Accounts Payable team to take required action and float a regular MIS for you. Now you can relax on the chair at the end of the year and don’t need to chase your team for the closure of financials on time.What do we do in Payment Processing

All payments are in your controls. Our team prepares an aging of payables, highlights the critical invoices, enlists the top vendors, creates a payment proposal in the accounting ERP system and makes available for your approval and submitting payment file to Bank. Whether you pay daily or weekly we make all the required data available for you to take a decision on your payables.

What is Vendor Statement Reconciliation? Is it important for effective accounts payable processing?

Are you getting statements from your top vendors? Are your payments applied to the correct invoices? Are you charged with the late fees on the statements? Do not let yourself struggle with the dispute merely due to the fact that your statements are not reconciled on time and avoid any undue late fees. Now you can easily focus on issuing 1099 forms on due dates and meet deadlines of annual returns.

Conceptual business illustration with the words accounts payable[/caption]

Some organizations are equally performing well as you are and need their books reconciled timely. A dedicated AP Help desk team addresses all queries coming from your vendor. This is required so that your vendors can be heard well to strengthen the organizational relationship.

Conceptual business illustration with the words accounts payable[/caption]

Some organizations are equally performing well as you are and need their books reconciled timely. A dedicated AP Help desk team addresses all queries coming from your vendor. This is required so that your vendors can be heard well to strengthen the organizational relationship.

What do we do in Vendor Statement Reconciliation?

We reconcile all vendor invoices and the payments issued to them considering all applicable discounts/returns and update the vendor periodically for any difference in the ledger. We coordinate with the vendor's Accounts Receivable team for any required correction.What is the importance of Vendor Data Management? Why should this be outsourced?

Do you have a large number of vendors? Do most of them are One Time or Frequent Suppliers? Are you concerned to have them correctly set-up in your accounting ERP system so that they are reported correctly in your returns? Hence, the correctly updated and managed vendor databases help in managing the day to day transactions smoothly as well as ensure accuracy tax ability at the end of the year.What do we do in Vendor Data Management?

We get the required details and tax certificates from your vendors while initial set up and keep them updated frequently year after year. We also address the vendor requests whenever they want their details updated like a change in name, tax ability, nature of business and contact information.Why is Vendor Help desk important for every business?

Conceptual business illustration with the words accounts payable[/caption]

Some organizations are equally performing well as you are and need their books reconciled timely. A dedicated AP Help desk team addresses all queries coming from your vendor. This is required so that your vendors can be heard well to strengthen the organizational relationship.

Conceptual business illustration with the words accounts payable[/caption]

Some organizations are equally performing well as you are and need their books reconciled timely. A dedicated AP Help desk team addresses all queries coming from your vendor. This is required so that your vendors can be heard well to strengthen the organizational relationship.What do we do in Vendor Help desk?

We set up a dedicated Mailbox and Desk Number so that your vendors can reach you. We log all queries received on the shared mailbox and the help desk number and address them in a sophisticated and timely manner. We also share an analysis of queries and design a solution plan so that such queries are minimized. We create such a team who makes the query resolution a pleasant experience for your vendors.What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex