Investment Structuring

Investment Structuring

What is Outbound Investment Structuring?

Under the automatic route, an Indian company is not required to take prior approval from the RBI for setting up JV/WOS abroad. The criteria for direct investment under the automatic route shall include- Investment up to 400% of the net worth

- Valuation requirements to be complied with to valuation of investment

- Indian company is not in RBI’s caution list

- Submission of APR in respect of all overseas investment

- Certain additional requirements are also to be complied with if the Indian company is engaged in providing financial services

- Also, the foreign companies engaged in real estate, trading in TDR’s and banking business required prior approval of RBI

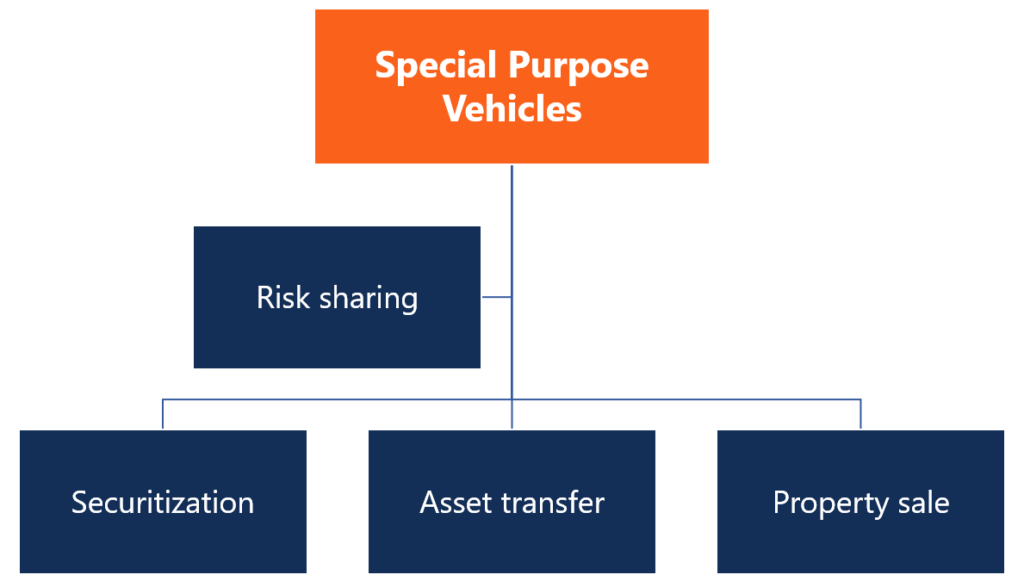

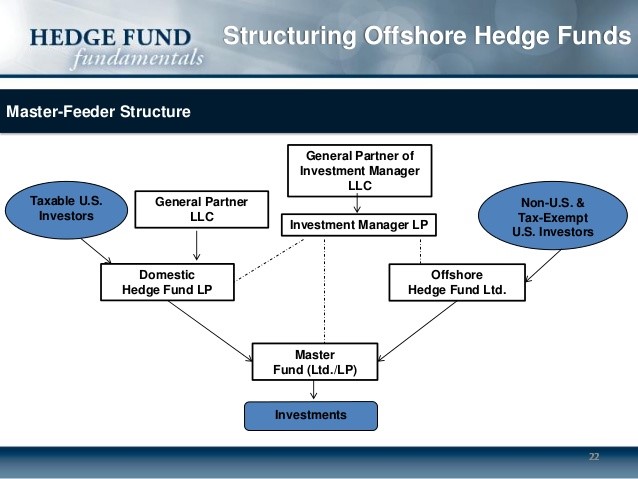

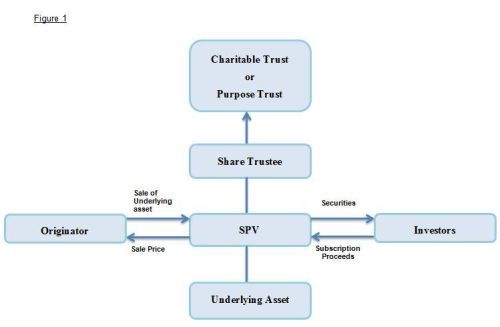

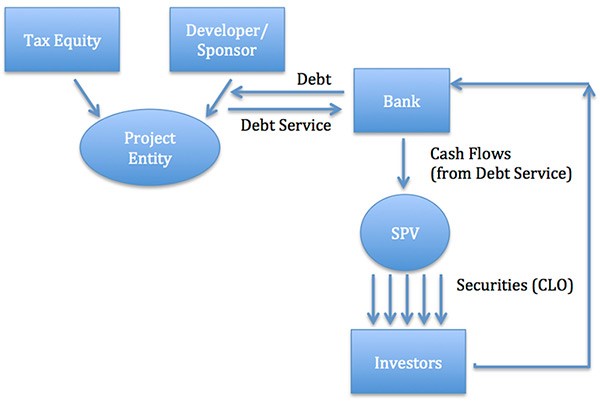

What is Benefits of SPV's?

- Flexibility in borrowing and corporate restructuring

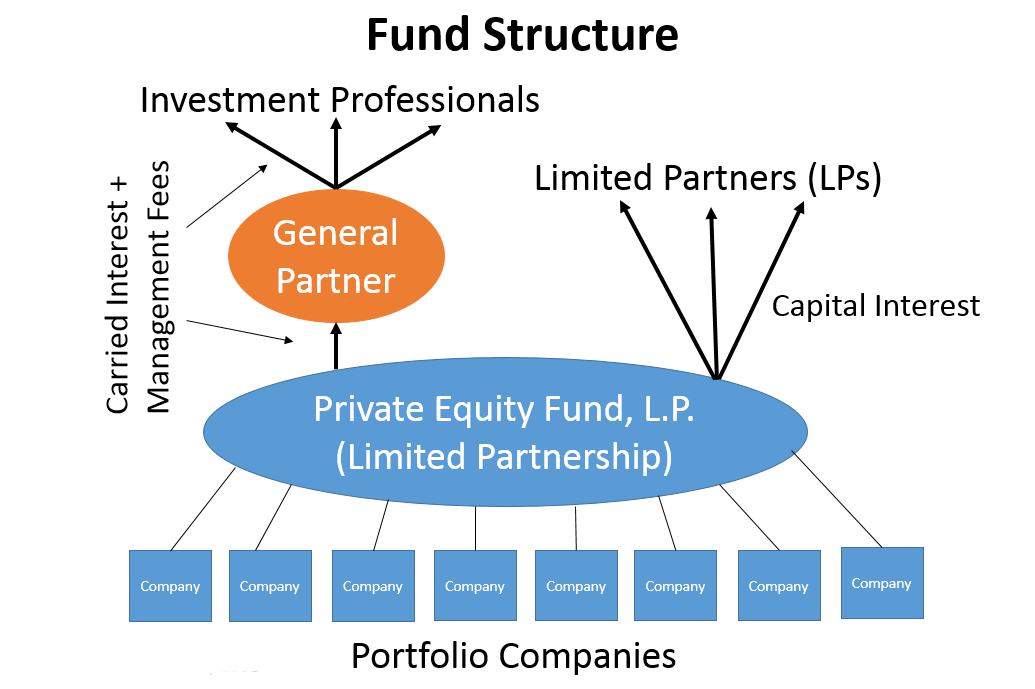

- JV Private Equity Funding

- Bilateral Agreements

- Tax Efficiency

- Ease of entry and exit

- Overseas Listing

Significance

1) Participation Exemption

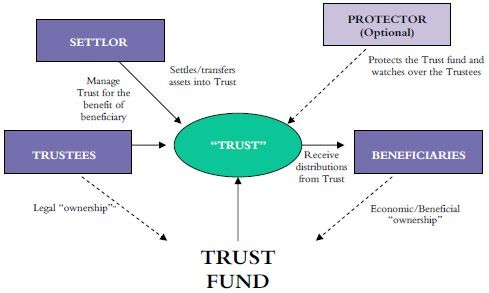

Benefit of exemption in the SPV's jurisdiction for dividend and capital gains coming from downstream investments on the fulfillment of certain conditions. Conditions basically include shareholding pattern, the jurisdiction of the parent entity and share of the holding.

IPR Regime

Specific deduction, exemptions, and incentives are available in some jurisdictions with regard to IPR holdings such as Patent Box Regime .i.e. concessional rate for royalty income in case of certain IPR’s and also deduction for certain cinematographic films given in the UK.

Withholding Tax provisions

Withholding tax exemptions on dividends, royalties, and interest

Favorable Holding Company Regime

Lower income tax rates for holding companies under specific holding company regimes, existence of CFS provisions, Good Treaty Network

Thin Capitalization Rules

Companies are said to be capitalized thinly when its capital comprise a greater proportion of debt equity. In such a case cash repatriation is possible by claiming tax deduction for interest on debt

Key Services Provided by us

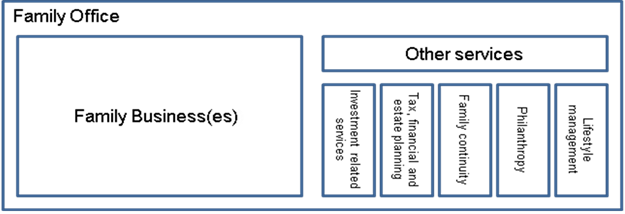

- Advice and assist on entity structuring, capital structuring and regulatory approval process in the selected jurisdiction

- Advice on cross-border investment strategies including suggestions for obtaining optimal ownership structures for investing into a particular jurisdiction which includes setting up an international holding company, global sales company etc.

- Assist in finalizing and review of the shareholders, joint venture and other business agreements or arrangements from tax perspective

- Identify and enhance tax and fiscal benefits including obtaining tax rulings in the selected jurisdiction

- Advice on tax credit claim in India and also Tax treaty implication

- Assist in obtaining approvals from Reserve Bank of India and also from the regulatory authorities.

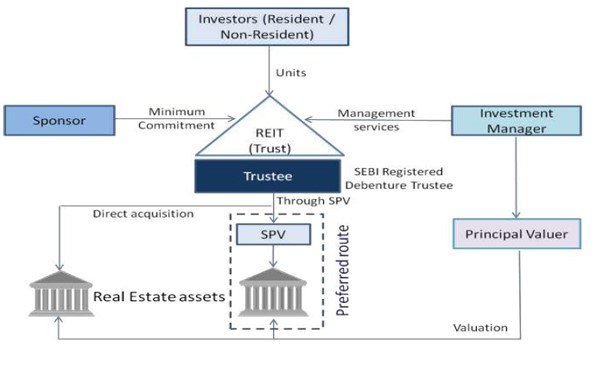

What is Inbound Investment Structuring?

Choice of Entity

Particulars |

Private Company |

LLP |

| Income Tax |

|

|

| Foreign Direct Investment/Foreign Exchange Management Regulation |

|

|

| Governance Framework |

|

|

Use of Holding Companies

Direct Investments in India

Foreign Investor > Indian Company Key Issues

- Capital gains on sale of shares are taxable in India

- Treaty Benefit in respect of capital gains is available only in selected countries

- Risk of double taxation due to conflicting source rules

Key Services provided by us for Inbound Investment Structuring?

- Advise on Indian entrance approach and suggestions for gaining finest ownership/jurisdiction for investing in India

- Advising on entity restructuring by selecting the finest entry vehicle such as setting up a branch, subsidiary, LLP or a Joint Venture

- Provide the services of capital restructuring in terms of foreign exchange policies keeping repatriation in loop

- Assisting in the filing, obtaining necessary approvals including regulatory compliances from Reserve Bank of India, Foreign Investment Promotion Board, Government of India or any other regulatory authority.

- Assisting and finalizing from the perspective of the shareholder, joint venture agreements, any other business arrangements or agreements from the tax perspective

- Target Due Diligence

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex