Prepaid Instruments License

Prepaid Instruments License

What is prepaid wallet License?

Prepaid Payment Instruments, also known as PPIs, are the payment instruments which facilitates the goods and services transactions conducted by the consumer, including financial services, remittance facilities etc., against the value stored on such instruments. The PPIs have emerged as a smart and convenient method of initiating cashless transaction in the recent times where the country has experienced a whole lot of cash crunch. It is an effective way of payment carried out it transparency, scalability and accountability.Generally PPIs are also called as e-wallets

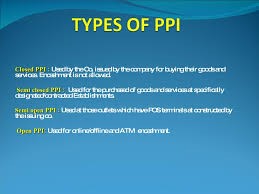

Closed Prepaid Payment Instruments or Closed wallets

these may be issued by any entity which may include individuals, sole-proprietorships, partnership firms etc. for the purchase of goods and services from that entity only.As these instruments cannot be used for payments and settlement for third party transactions, the issue and operation of such do not require approval by the Reserve Bank of India.Semi-closed Prepaid Payment Instruments or Semi-closed wallets

PPIs under this category can be used for purchase of goods and services from a group of merchants united for this only purpose. Cash withdrawal and redemption is not allowed by the holder of such instruments. All entities including individuals, NBFCs are permitted to carry on the business of semi-closed wallets after getting license from Reserve Bank of India.Open wallets

This is a type of wallet which can be used to purchase goods and services and also permit cash withdrawal at ATM's. These wallets can be used for purchase of goods including financial services such as funds transfer at merchant locations, also cash withdrawal at automated business correspondents. Thus these are wallets used to buy goods and services, including fund transfer at merchant locations, also permit cash withdrawals at ATM'S. All Visa and master cards fall into this category. Only banks are authorized to issue and operate open-wallets.Cross Border Transactions

The individuals authorized under FEMA to issue the Foreign Exchange denominated Prepaid Payment Instruments do not attract the provisions of PPI guidelines as per the RBI notification. The transaction limit is set for INR 5000/- for such cross border transactions.Minimum Capital Requirements

- Banks: there is no separate capital requirement specified for Licensed/Scheduled Banks or NBFCs registered with Reserve Bank of India. They shall be authorized to issue the PPI after obtaining approval from RBI.

- For other entities: A minimum positive net-worth of 25 crores as per the last audited Balance Sheet shall be maintained by all entities seeking approval.

Other conditions relating to capital requirements

- The Net worth shall consist of the following items:

- Paid-up Equity capital;

- Preference shares;

- Free Reserves;

- Share premium account; and

- Capital reserves representing surplus.

- In case of newly incorporated companies, a certificate from their Chartered Accountant regarding the current net worth along with provisional balance sheet shall be submitted. Moreover, the documents in relation to capital infusion and other funds acquired to start the business shall also be submitted.

- In case of Banks and NBFCs, the approval is given by the Supervisory Department of the RBI.

- The existing PPI issuers who obtained the license from RBI under previous capital requirements shall be liable to increase their net-worth in accordance with the present criteria by September 30, 2020, failing which their license shall be cancelled.

- Only an entity incorporated under Companies Act, 1956 or Companies Act, 2013 shall be authorized to apply for the license from RBI.

- The object clause of the MOA of the applicant company shall specify the proposed activity of operating as a PPI issuer.

Authorization Process for Non-Bank entities

- An application shall be made by every non-bank entity seeking approval for license in Form A as prescribed under Regulation 3(2) of the Payment and Settlement System Regulations, 2008.

- First of all, RBI judges the prima-facie eligibility of the applicant in preliminary screening.

- Further, the ‘fit and proper’ status of the applicant and the management is assessed after intake of feedback from regulators, government authorities etc.

- In case the applicant entity does not meets the eligibility criteria, the application shall be returned with no refund of the fees.

- Apart from the eligibility criteria, the application shall also be assessed on the grounds such as customer service and efficiency, technical and other related requirements.

- On the fulfillment of every condition, the in-principal approval is granted by the Reserve Bank of India, whose validity is of six months. Within six months of the in-principal approval, the entity is required to submit a satisfactory System Audit Report, failing which the in-principle approval shall lapse automatically.

- The entities which have been granted final approval shall commence their operations within six months of the approval failing which the authorization shall lapse automatically. A one-time extension of six months can be obtained by making a request in writing in advance to the RBI with valid reasons. The RBI reserves the right to accept or reject such application for extension.

- The Certificate of Authorization shall be valid for five years from the date of its grant.

- For renewal of license, the application to the RBI shall be submitted three months prior to the expiry of the license, failing which RBI reserves the right to accept or reject such application for renewal.

Documents Required

For Prepaid wallet license- Name of applicant.

- Constitution of applicant.

- Address proof of registered office.

- Certificate of Incorporation.

- Main business of company.

- Management information.

- Statutory auditor of Company.

- Audited balance sheet.

- Name and address of bankers of Company.

- Any other documents as may be required.

Prior written permission by Non-Bank entities

All non-bank entities being granted the Certificate of Authorization to issue PPIs in the country shall be required to take written approval from the Reserve Bank in the following cases:- Any takeover or acquisition of control of non-bank entity, which may or may not result in change of management;

- Any change in the management of non-bank entity, which would result in change in more than 30 per cent of the directors, excluding independent directors. Prior approval shall not be required for those directors who get re-elected on retirement by rotation.

Deployment of money collected on PPIs

The amount of funds collected against the issuance of e-wallets at a point of time could be significant. Moreover, the revenue from funds may also be speedy. In case the settlement of funds is certain and in a timely manner, the confidence of the public and merchants, on the e-wallet system shall increase rapidly. To guarantee the timely settlement, the issuers shall invest the funds collected only as from the issuance of e-wallets as follow: The banks shall keep the outstanding balance as a part of ‘net demand and time liabilities’ for maintaining the reserves in the Balance Sheet which shall be calculated on the basis of the balances appearing in the books of the bank as on the date of reporting to the RBI.- Any other entity or persons issuing e-wallets shall keep reserved the outstanding balance in an escrow account with any scheduled bank by RBI subject to the satisfaction of following conditions: -

- The account shall be maintained with only one bank at one time;

- In case the aforesaid account is being shifted from one bank to another, it shall be kept in mind that the process in completed in a time-bound manner and without affecting the payment cycles;

- The balance lying in the account shall always be equal to or greater than the value of outstanding PPIs and payments due to merchants;

Validity of PPIs License

All PPIs issued by the PPI issuers shall have a minimum validity of one year from the date of its issuance to the PPI holder. The PPI issuers shall intimate the users about the expiry of their PPIs in a timely manner by SMS / e-mail / post or by any other means in the language preferred by the holder indicated at the time of issuance of the PPI. Even if the PPI expires, a grace period of at least 60 days shall be given by the PPI issuer to the customer.What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex