Mutual Fund Registration

Mutual Fund Registration

What is Registration of Mutual Fund with SEBI?

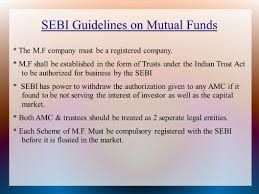

- A mutual fund is set up in the form of a trust, which has sponsor, trustees, Asset Management Company (AMC) and custodian. The trust is established by a sponsor or more than one sponsor who is like promoter of a company. The trustees of the mutual fund hold its property for the benefit of the unit holders.

- Asset Management Company (AMC) approved by SEBI manages the funds by making investments in various types of securities. Custodian, who is registered with SEBI, holds the securities of various schemes of the fund in its custody. The trustees are vested with the general power of superintendence and direction over AMC. They monitor the performance and compliance of SEBI Regulations by the mutual fund.

- An applicant proposing to sponsor a mutual fund (MF) in India must submit an application in Form A [first schedule of the SEBI (Mutual Funds) Regulations, 1996 (hereinafter, referred to as the Regulations)] along with a non-refundable fee of INR 5 lakh.

- The application is examined and once the sponsor satisfies the eligibility criteria, it is required to complete the remaining formalities for setting up a MF. These include inter alia, executing the trust deed and investment management agreement, setting up a trustee company/board of trustees comprising two-thirds independent trustees, incorporating the asset management company (AMC), contributing to at least 40% of the net worth of the AMC and appointing a custodian. Upon satisfying these conditions, the registration certificate is issued subject to the payment of registration fees of INR 25 lakh.

Procedure for registering a mutual fund with SEBI

An application for registration of a mutual fund shall be made to the Board (SEBI) in Form Aby the sponsor along with the non-refundable fee of INR 5 lakh.Eligibility criteria

The applicant has to fulfil the following criteria for grant of a certificate of registration: The sponsor should have a sound track record and general reputation of fairness and integrity in all his business transactions. Explanation: For the purposes of this clause "sound track record" shall mean the sponsor should- Be carrying on business in financial services for a period of not less than 5 years; and

- The net worth is positive in all the immediately preceding 5 years; and

- The net worth in the immediately preceding year is more than the capital contribution of the sponsor in the asset management company; and

- The sponsor has profits after providing for depreciation, interest and tax in 3 out of the immediately preceding 5 years, including the 5 year.

- The applicant is a fit and proper person.

- The sponsor or any of its directors or the principle officer to be employed by the mutual fund should not have been guilty of fraud or has not been convicted of an offence involving moral turpitude or has not been found guilty of any economic offence;

- Appointment of trustees to act as trustees for the mutual fund in accordance with the provisions of the regulations;

- Appointment of Asset Management Company to manage the mutual fund and operate the scheme of such funds in accordance with the provisions of these regulations;

- Appointment of custodian in order to keep custody of the securities or gold and gold related instrument or other assets of the mutual fund held in terms of these regulations, and provide such other custodial services as may be authorised by the trustees

#Mutual fund registration #SEBI registration #SEBI advocate #SEBI law consultant #SEBI Consumer complaint #SEBI Consumer dispute

SEBI may register the mutual fund on receipt of all the information and accordingly decide to grant acertificate of registration in Form B subject to the payment of registration fees of INR 25 lakh.

SEBI may register the mutual fund on receipt of all the information and accordingly decide to grant acertificate of registration in Form B subject to the payment of registration fees of INR 25 lakh.

A mutual fund shall pay before the 15th April each year an annual fee as specified under for every financial year from the year following the year of registration

|

Average Assets under Management (AAUM) as on 31 March |

Annual Fee |

|

AAUM up to INR 10,000 crore |

0.0015% of the AAUM |

|

Part of AAUM above INR 10, 000 crore |

0.0010% of the portion of AAUM in excess of INR 10,000 crore |

Subject to a minimum of INR 2, 50,000 and a Maximum of INR 1, 00, 00,000.

Where the sponsor does not satisfy the eligibility criteria SEBI may reject the application and inform the applicant of the same.

Subject to a minimum of INR 2, 50,000 and a Maximum of INR 1, 00, 00,000.

Where the sponsor does not satisfy the eligibility criteria SEBI may reject the application and inform the applicant of the same.

What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex