NBFC Account Aggregator ( NBFC-AA) License

-License-small.jpg)

NBFC Account Aggregator ( NBFC-AA) License

What is an Account Aggregator?

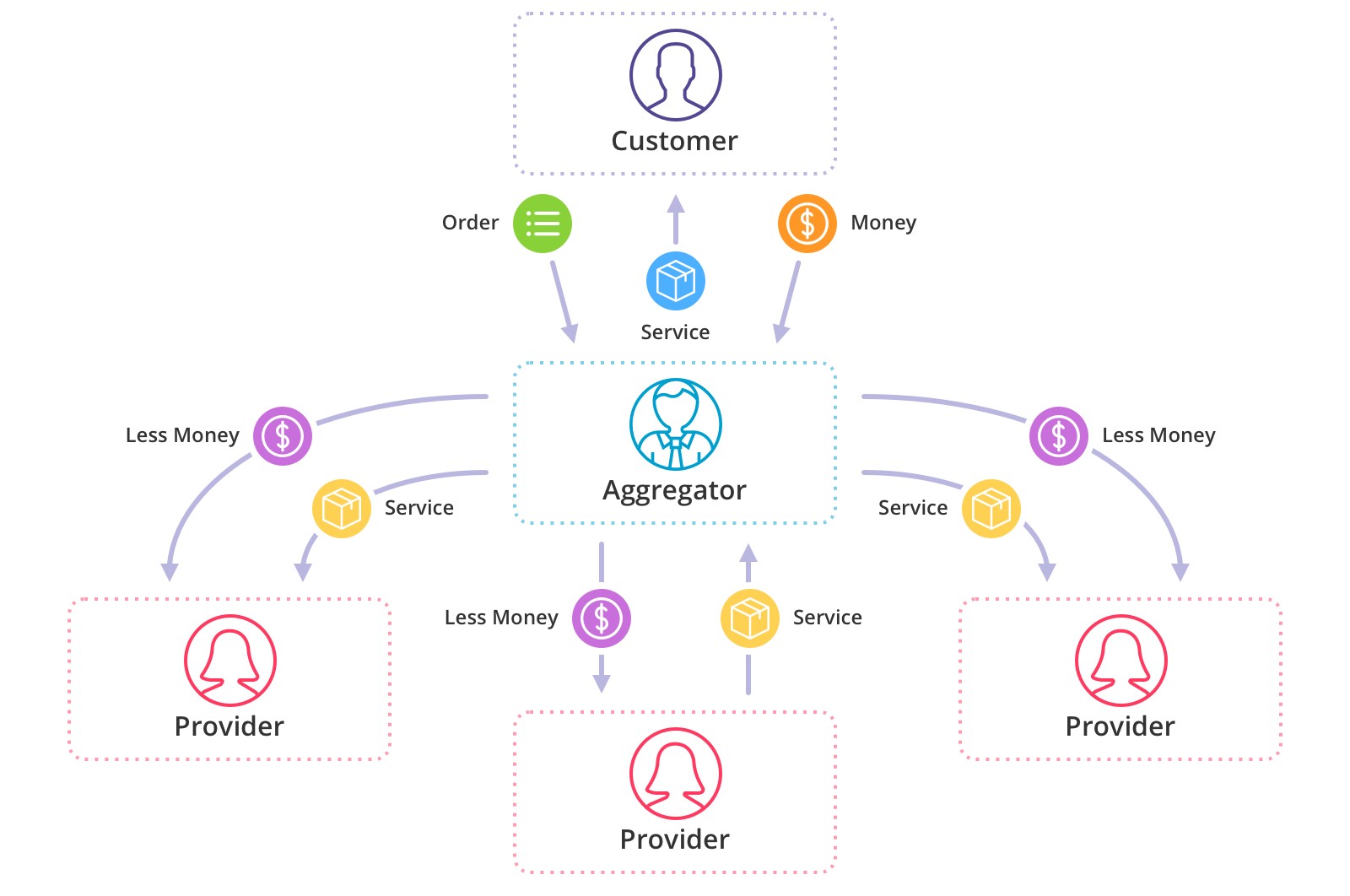

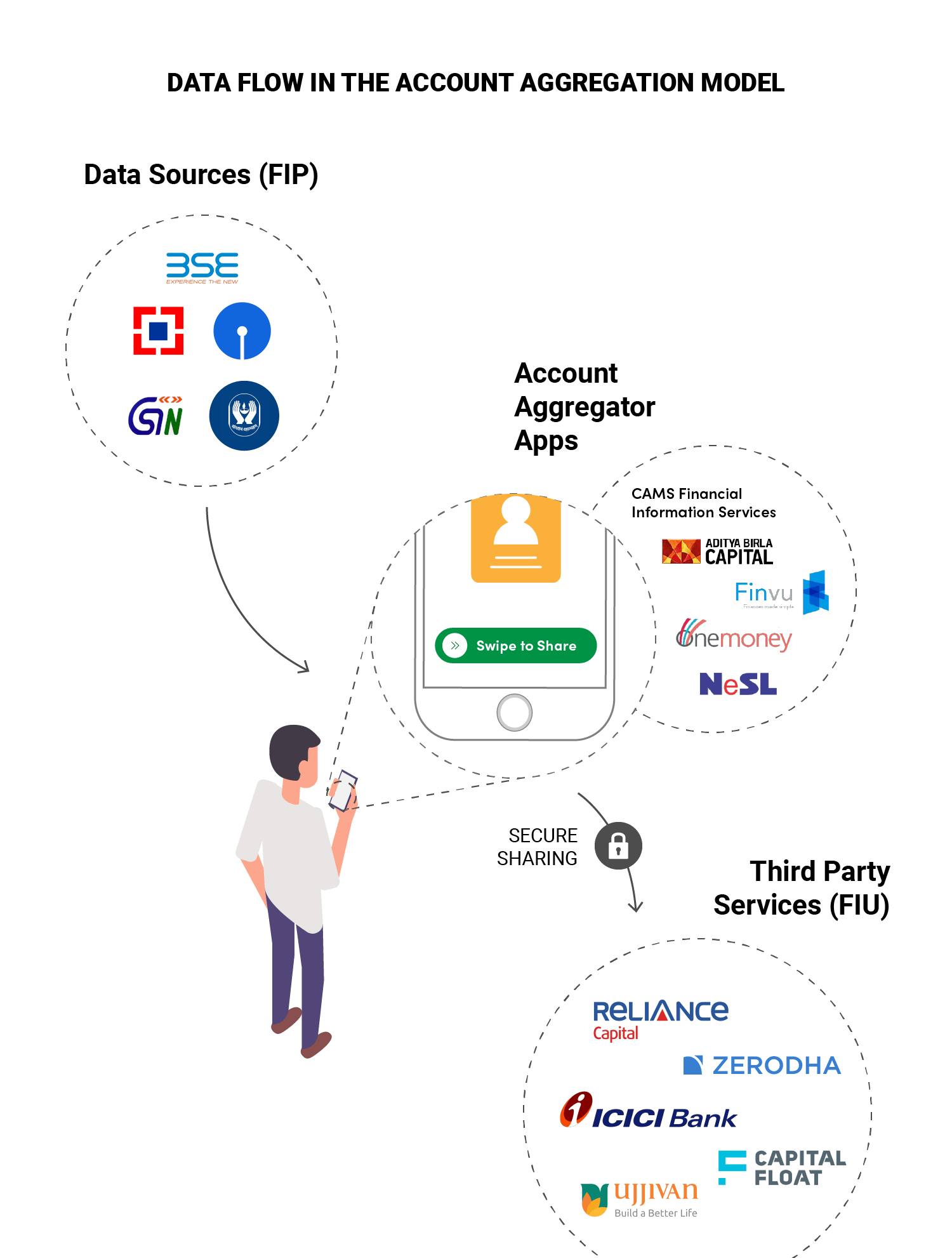

Before coming to the NBFC Account Aggregator license, it’s important to understand the term “Account Aggregator”. Account Aggregators are such type of entities which enable financial data sharing across financial institutions besides maintaining a record & obtaining consent. Under this, consent can be revoked and managed. They share financial data from a financial information provider to the financial information user. For your better understanding let us explain you the meaning of both the terms:

- Financial Information Provider (FIP):An entity offering financial services regulated under the financial sector;

- Financial Information User (FIU): An entity regulated by financial sector regulators such as RBI, SEBI, IRDA, PFRDA.

Note: Financial information is defined under master directions as:

“Financial Information” means information in respect of the following with financial information providers:

What is NBFC Account Aggregator?

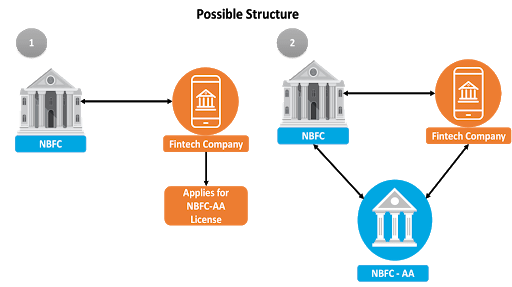

NBFC Account Aggregator is those types of entities which act as consent broker which will enable financial data sharing among financial institutions in the financial sector. However, the data can only be transferred with the consent of the user. This was conceptualized by the RBI in the year 2015. For Non-Banking Finance Companies - Account Aggregators (NBFC-AA), RBI has announced master directions. NBFC-AA (NBFC Account Aggregator) is a type of financial entity which is indulged in providing information to NBFC customers related to accounts held by customers in different NBFCs. Such information will be in a consolidated and organized manner. The information will be concerned with the financial engagement of a customer with the d ifferent products of NBFC.

ifferent products of NBFC.

The Significance of NBFC-AA (NBFC Account Aggregator)

The main function of the NBFC-AA is to give information regarding the accounts held by customers. Information is held in an organized, consolidated and retrievable manner. For a customer, it is completely voluntary to avail the services of the account aggregator. The NBFC-AA performs IT-oriented activities which mean that customer will get digital information. The main role of NBFC-AA (NBFC Account Aggregator) is account aggregation; therefore, they will not enter into financial assets transaction with its customers, unlike other NBFCs. An aggregator is permitted to deploy investible surplus in instruments & not for trading. Board-approved policy of the account aggregator will decide the pricing of services. Such guidelines & policy adopted by the account aggregator must be transparent and available in the public domain. The services rendered by the NBFC-AA (NBFC Account Aggregator) must be secured by the appropriate agreements/ between the aggregator, customer and financial service provider. The terms and conditions of the license must be followed by NBFC-AA (NBFC Account Aggregator) like protection of customer, grievance redressal, data security, corporate governance, audit control, and risk management framework. Financial Stability and Development Council (FSDC) comes with the idea of NBFC-AA. Precisely, NBFC-AA (NBFC Account Aggregator) collects information regarding the customer’s financial assets and provides it to the customers in a consolidated, organized and retrievable manner. Set of guidelines had been drafted by the RBI which must be followed by these types of entities.What are the Requirements for NBFC-AA Registration?

For NBFC-AA (NBFC Account Aggregator) license, there is a requirement of minimum Rs. 2 crore. However, the company will have a time period of 12 months to raise money after obtaining the in principle approval from RBI. No services can be provided other than account aggregation by NBFC-AA (NBFC Account Aggregator).

After receiving the in-principle approvals from the regulator, NBFC-AA (NBFC Account Aggregator) will have a time period of 12 months to put in place all the necessary technology and tie-ups required to carry out this business of aggregation.

As per the RBI, an entity which is indulged in aggregating accounts of a particular financial sector regulated by the other regulators can be exempted from obtaining approval of RBI. RBI regulates the NBFC-AA (NBFC Account Aggregator). These types of entities are not allowed to carry financial activities like other NBFCs.

NBFC-AA will provide information to the financial user regarding the customer. They are not eligible to do any fund based activities like other NBFCs. Prima facie we cannot consider them as NBFCs by nature. NBFC Account Aggregators cannot utilize the information of the financial assets of the customers for any other purpose.

What are the Duties & Responsibilities of NBFC Account Aggregators?

The prime responsibility of the NBFC-AAs is to collect information of any customer under explicit consent and disseminate such information. Here are the following duties and responsibilities of the NBFC-AAs (NBFC Account Aggregators) as per the directions laid down by the RBI:- Obtain customer consent;

- Obtain in principal approval to render such activities ;

- Method of proper customer identification;

- For the protection of customer’s rights laid down Citizen’s Charter; and

- Safeguard financial information of customers

- Ensure that no information is retrieved and transferred without obtaining the proper consent of the customer

What is the Process of NBFC-AA Registration?

The process of NBFC-AA registration is carried out on the basis of master directions issued by the RBI. This type of entity shall not hold public funds and will not have any customer interface. For NBFC-AA (NBFC Account Aggregator) registration, the following steps need to be undertaken:

- The first step is company registration as per Companies Act, 2013.

- The company must have the necessary resources to offer such type of services.

- To undertake the business of account aggregator, the company had made proper arrangement of adequate capital structure.

- The general character of the management is not prejudicial of public interest.

- For carrying out the activities of account aggregator it is mandatory to obtain Certificate of Registration (CoR) from RBI.

- For obtaining Certificate of Registration (CoR), an application is required to be made with the RBI by the applicant.

- There is a requirement of a minimum of Rs. 2 crore.

- Equipped with information technology system in order to carry out services of account aggregation

- Promoters of the NBFC-AA must be fit and proper

- Leverage ratio should not be more than 7 times

What needs to be done by the NBFC-AA (NBFC Account Aggregator) during the validity period of in-principle approval?

During the validity period, the company shall make arrangement for an information technology platform and complete all the legal documentation which is necessary to carry out operations. However, in the case of noncompliance, RBI may cancel the CoR of NBFC-AA:- If the company cease to carry the operation of account aggregation;

- The company is not complying the conditions subject to which the certificate of registration has been issued by the RBI; or

- If it is found that NBFC-AA (Non-Banking Financial Company-Account Aggregator) is no longer eligible to hold the certificate of registration; or

- If the company fails to comply with the following conditions:

- Directions issued by RBI; or

- Maintaining accounts;

- Publish and disclose its financial position in accordance with the law;

- Inspection of books of account.

What are the fit and Proper Criteria for Promoters as per RBI?

For the purpose of fit and proper criteria, NBFC-AA (NBFC Account Aggregator) shall:- Draft a policy for ascertaining the fit and proper criteria of promoters.

- The policy will be completely based on the guidelines issued by RBI.

- A declaration shall be obtained from the directors/ managing director/ CEO as per the format provided under directions.

- A covenant deed shall be obtained by the directors/ managing director/ CEO as per the format provided under directions.

- Furnish annual statement on change of directors/ managing director/ CEO duly certified by the Statutory Auditors regarding the fit and proper criteria within 15 days from the closure of the financial year.

Norms for Data Security by NBFC-AA (NBFC Account Aggregator)

It is mandatory for NBFC-AA to have proper IT infrastructure as they carry a lot of financial information of various customers. These types of entities shall be solely responsible for the safe storage & transfer of data from financial information providers to financial information users. They would also have to ensure that customer credentials cannot be retrieved or stored in their system. For the purpose of safety of data, the following have been described under directions;- Protection from unauthorized access, alteration, destruction, disclosure, or dissemination of records and date

- Use the technology platform in relation to keep financial information;

- Take necessary action for risk management

- Information System Audit by CISA certified external auditor timel

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex