RERA Registration

RERA Registration

What is RERA (Real Estate Regulatory Act)?

The Real Estate (Regulation and Development) Act, 2016 introduced with a view to establish regulatory authorities at the state level to register residential real estate projects and seeks to regulate contracts between buyers and sellers in the real estate sector to ensure sale of plot, apartment or building, etc. in an efficient and transparent manner. It also proposes to ensure greater accountability towards consumers, and significantly reduce frauds and delays as also the current high transaction costs.

By imposing certain responsibilities on purchasers and promoters, it attempts to balance the interest of both. It seeks to establish the following:

- Ease of information between the Promoter and Purchaser;

- High level of transparency of contractual Conditions;

- Set minimum standards of accountability and;

- A fast-track dispute resolution mechanism.

Why there is a need for RERA in India?

In India, the real estate sector plays a vital role in fulfilling the need and demand for housing and infrastructure development. While this sector has grown rapidly in recent years, it has been largely unregulated though in India there is state apartment act with the absence of professionalism and standardization. The lack of adequate consumer protection mechanism resulted in exploitation and profiteering by unscrupulous builders. Thus, the Real Estate Act will protect the interest of buyers and also give much-needed impetus to the sector.

What is the impact of RERA on Real Estate Sector?

With the introduction of RERA, State Real Estate Regulatory Authority and the Real Estate Appellate Tribunal have been established in order to resolve the disputes pertaining to purchase of the property. There will be no other consumer forums and civil courts for the aggrieved party to settle down such matters. For fast-tracking dispute resolution, the groundwork is set up by the RERA. However, its success depends upon the timely establishment of new dispute resolution bodies and expeditious resolution of disputes.

Following are the key impact of RERA on Real Estate Industry:

- Increase in Project cost and Cost of Capital

- Tight liquidity

What are the main objectives of enforcement of RERA Act?

Following are the main objectives of enforcement of RERA Act:

- Establishing a fast-track dispute resolution mechanism;

- Ensuring accountability towards buyers and protect their interest;

- Infusing transparency, ensure fair-play and reduce frauds & delays;

- Ensuring the sale of real estate project, in an efficient and transparent manner;

- Introducing professionalism and pan India standardization;

- Establishing symmetry of information between the developer and buyer;

- Imposing certain responsibilities on both developer and buyers;

- Promoting good governance in the sector and create investor confidence;

What are the benefits of RERA Registration?

- Timely delivery

It has been seen that developers often make false promises about the completion date of the project, but hardly deliver on time. As per the bill, strict regulations will be enforced on developers to ensure that construction runs on time and flats are delivered on decided time. In case if the builder is not able to deliver the flats on time, he/she will be liable to refund the amount to the purchaser with interest.

- Accurate Project Details

In the construction stage, builders promote their projects, defining the various amenities and features related to projects. As per this bill, there can't be any changes to a plan. And if a builder is found guilty then, he/she will be penalized 10% of the project's costs or face jail time of up to three years.

- All clearances

Builders often attract buyers with huge discounts and pre-launch offers. And, the buyer, enticed by the offers, does not bother about the clearance. But, due to delays in getting clearance, the buyer does not get the flat on time. This bill ensures that developers get all the clearances before selling flats.

- Proper Structure

If the buyer finds any structural deficiency in the development of the building, then it is the developer's responsibility to repair structural defects up to 5 years.

- No Advertisement without RERA Registration

Promoters are not permitted to advertise any project without RERA registration with the Real Estate Regulatory Authority established under this Act. Additionally, each advertisement has to carry the RERA registration number.

- Booking Amount

The amount to be paid by the buyer has been reduced from 20% to 10%, which should be paid only after registering the agreement for sale with the builder. Termination of the agreement is permitted only if the buyer defaults on payment thrice. The Buyer is entitled to a 15-day notice.

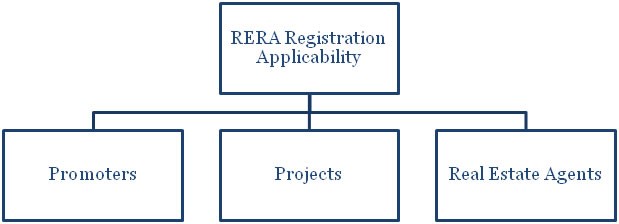

Who all are required to apply for RERA Registration?

RERA registration is applicable on promoters, project and real-estate agents subject to the following conditions:

- The applicability of the Act has been extended to commercial and residential real estate (including plotted development).

- All the residential and the commercial projects exceeding 500 square meters or more than 8 units/apartments have to mandatorily apply for RERA registration with the Real Estate Regulatory Authority (RERA); thereby ensuring that even the small projects by local promoters are brought under the ambit of the Act.

- All the ongoing projects that have not received Completion Certificates have also been brought under the purview of the Act and such projects will need to apply for RERA registration with the Regulator within 3 months.

- Prior RERA registration is required to be taken from RERA under respective state laws by the Real estate agents who facilitate selling or purchase of properties. RERA Registration certificate is valid for all over the state / UT.

- Application for RERA registration must be approved or rejected within a period of 30 days from the date of an application made.

- On successful RERA registration and approval from the authority, the promoter of the project will be provided with a unique registration number, a login id, and password for the applicants to update the necessary details about the company and project.

In case of failure to apply for RERA registration, a penalty of up to 10 percent of the project cost or three years’ imprisonment may be imposed.

What are the criteria for RERA Registration fee for different category of applicants?

- RERA Registration fees in Maharashtra

- Project Registration Fee

Project registration under MH-RERA Rs. 10 per square meter or Rs. 50,000 minimum and maximum Rs. 10 Lac.

- RERA Agent Registration Fee

Agent registration under Maharashtra RERA Rs. 10,000 in case of individual and Rs. 100,000 in case others.

- RERA Registration fees in Uttar Pradesh

- Project Registration Fee

| In case residential Apartments / Project in UP |

| Rs.10 per square meter for Project size less than 1000 Square meter. |

| Rs.500 per 100 square meter for project size exceeds 1000 square meters. |

| In case of commercial projects in UP |

| Rs.20 per square meter for projects size less than 1000 square meters. |

| Rs.1000 per 100 square meter – For projects size more than 1000 square meters. |

- RERA Agent Registration Fee

For Agent registration under RERA as individual Rs. 25000 and in case of others Rs. 2,50,000/-.

What are the documents required for RERA registration Process in India?

Documents required for RERA registration vary from state to state. Here are the following basic documents required for RERA registration:

Documents required from developers to register an on-going project:

- In case promoter is individual then basic details such as name, address, photograph and contact details.

- In case of other than individual, details of chairman, partners, directors, and authorized person and details of an entity such as the type of entity, name and address of the entity.

- Copy of PAN and Aadhar of promoter

- Copy of approval obtained from the competent authority

- Development Plan

- Project details (location of the project, layout and sanctioned plan of the project)

- Details of designing standards, construction technology type, resistant measures in case of the uncertain event and amenities/facilities in the layout plan.

- Income Tax Returns (ITR) and audited financial statements of the past 3 years.

- Title Deed along with the chain of title

- Documents of ownership such as proforma of the allotment letter, sale agreement, and conveyance deed.

- Details of the architect, engineers, and others.

- If the promoter is not the owner then consent detail of the owner along with the collaboration agreement, development agreement, joint development agreement, title deed or any other agreement entered into between the promoter and owner.

- Any other document asked by the authority

Documents required for Agent Registration

- Details of the real estate agent such as name, address, contact details and photographs of individual/ partners/ directors.

- Copy of PAN and Aadhar of the Real Estate Agent

- Copy of the address proof

For whom RERA registration process is not mandatory?

As per section 3 of the RERA Act, RERA registration of projects is not necessary in below-mentioned cases:

- If the promoter has project completion certificate prior to the commencement of Act.

- The area of the proposed land does not exceed 500 sq. mt.

- Not more than 8 apartments

- In case of repair/renovation of an existing building where there is no need for marketing, advertising, and selling.

What is the procedure of RERA registration?

Every promoter and agent have to register themselves with the state RERA authority as per the RERA Act. There is a prescribed procedure for the registration of real estate projects and agents.

RERA registration is done in respect of commercial projects as well as residential projects along with the necessary documents and prescribed fees.

RERA registration of Projects as per RERA Act

Following process is followed by the promoter to register a project

- Convene board meeting to pass the board resolution in respect of the following:

- Separate bank account opening to cover the cost of construction

- Filing of the RERA registration application

- Approval of the allotment letter, sale agreement, and sale deed

- Obtain title search report in relation to proposed land

- Obtain necessary licenses & NOC from the government authorities such as Fire Department, Airport Authority of India, National Highway Authority of India, National Authority Disaster Management Authority etc.

- Collection of all the necessary documents for filing application in Form A

- Filing of a RERA registration application with the respective state authority along with the prescribed fees

Note: Currently in Maharashtra, online application can be filed while in Uttar Pradesh physical copies of documents are required to be dispatched.

- Registration certificate of the project is obtained in Form C as per section 5 of the Real Estate (Regulation and Development) Act, 2016.

RERA registration of Real Estate Agents

Following process is required to be followed by the Real Estate Registration:

- For RERA registration, an application form will be filed along with fee and necessary documents.

- After filing of the application, you will receive a registration number from the regulator which must be mentioned in documents related to the sale of the property.

- Books of accounts, records and other transaction-related documents are required to be maintained on a quarterly basis.

- You have to give detailed information and documents regarding the project you entered with the buyer.

- While filing an application, you must be aware that the agent may be suspended in case of misrepresentation of facts or fraud at the time RERA registration.

As per the RERA act, non-registration of projects may lead to heavy penalties.

What will be the validity period of RERA registration and what are the provisions regarding extension?

The RERA registration shall be valid for such period as decided by the Promoter for project completion or period described in the affidavit along with the RERA registration application. However, on the receipt of application from the Promoter for an extension, the authority may grant the extension under the below-mentioned circumstances:

- Force Majeure:In the case of war, flood, drought, fire, cyclone, earthquake, a natural calamity which may affect the development of the real estate project.

- Other than force majeure: If the authority finds that the reasons given for extension are reasonable then the extension will be provided of a maximum period of one year.

What are the rules regarding revocation of RERA registration?

In respect of real estate project, RERA act stipulates various compliances. RERA registration may be revoked if the prescribed compliances are not complied with. RERA registration may be revoked by the authority on the basis of a complaint received or on suo moto basis by giving 30 days written a notice to the promoter. Such written notice may be given on the basis of the proposed revocation.

On receiving the notice, the promoter will give the show cause notice as to why the RERA registration should not be revoked by the authority.

After this, the authority will either allow the real estate project to be registered or cancel the RERA registration.

On the following grounds, show cause notice may be issued:

- In case of default made by the promoter;

- In case of the violation of the terms and conditions by the promoter;

- If it is found that Promoter is indulged in unfair practice and in any fraudulent practices like misrepresentation / publication of any advertisement which are not intended to be offered;

What will be the consequence of non registration?

As per section 59 of the RERA Act, in case of non registration there is a penalty of up to 10% of the estimated project cost and in case of continuous default there will be an additional fine of up to 10% of the estimated project cost or 3 years imprisonment or both.

As per section 31 of the RERA Act, a complaint may be filed by the aggrieved person with the authority in case of violation of the RERA provisions by the promoter. There are wide powers entrusted with the authority in relation to non-compliance by the Promoter. Authority may levy a penalty or take the remedial measures/safeguards as may be deemed fit. On the case, to case basis, authority may grant interim order(s), refund of the amount received by the Promoter.

What are the rules regarding a loan from banks or financial institutions?

In case the real estate project is not registered or the registration has been canceled, then loan given by the banks and financial institutions to the retail buyers will involve high risk and uncertainties regarding the real estate project completion. In relation to such real estate project, action taken by the RERA authority may be detrimental to the interest of such bank / financial institution.

Therefore Banks / Financial Institutions also insist for RERA registration before sanctioning the loan to the buyers in order to protect their interest.

Is RERA registration gives protection to the buyers?

Yes, buyers feel more secure if the project is registered as it makes mandatory for developers to rectify the faults in the construction which came into notice after receiving the possession. It will improve the transparency in the real estate sector.

What are the market changes after one year of implementation of RERA?

After one year of implementation of RERA, some of the buyers are questioning the legislation as changes are not visible to them on the ground whereas developers feel that RERA bought transparency in the real estate sector.

The debate will continue but according to our government has taken the good initiative to bring accountability in the real estate sector and enhance the confidence of the buyers.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex