Tax Audit services

Tax Audit services

What is TAX Audit?

An audit simply means inspection, a review or check, so tax audit is when a filed tax is under review. A tax audit happens when an IRS decides that your tax is to be examined closely and to be verified weather your income and its deductions are accurate. Typically a tax return comes under tax audit when something entered by you is out of the ordinary.When a TAX Audit is Applicable?

It is applicable when your business turnover exceeds ?100 lakh in a financial year. Or when you are simply a professional and your gross receipts in your profession goes beyond ?25 lakhs in a financial year.What should You do to be Safe from a Tax Audit?

A business or profession is carried out with a motive in mind for financial profits. And it is important to keep in mind that they should be appropriate profits without any suspicious record-less reports. So what you can do is the following:-

A business or profession is carried out with a motive in mind for financial profits. And it is important to keep in mind that they should be appropriate profits without any suspicious record-less reports. So what you can do is the following:-

- Maintenance of accounts book which is mandatory as per the income tax act in India.

- Profit or gain should be computed which are computable under Chapter IV.

- Income is Taxable or Loss allowable under act of India.

- Show taxable income and allowable loss in tax return file.

What Type of Accounts Come under Tax Audit?

- Individual/Proprietorship.

- (Hindu undivided family)

- Company

- Partnership Firm.

- Association of person.

- Local Authority.

What is Included in Turnover for TAX Audit?

Duty drawback received on export sales shall be considered as part of Turnover in a financial year. Income made out of interests from income by money lender or through Foreign fluctuation income by an exporter shall be considered as part of turnover in a financial year or Advance received & forfeited from customers and if excise duty included in turnover it should be again debited in the profit and loss account.

Duty drawback received on export sales shall be considered as part of Turnover in a financial year. Income made out of interests from income by money lender or through Foreign fluctuation income by an exporter shall be considered as part of turnover in a financial year or Advance received & forfeited from customers and if excise duty included in turnover it should be again debited in the profit and loss account.

Things that are Excluded in Turnover for TAX Audit?

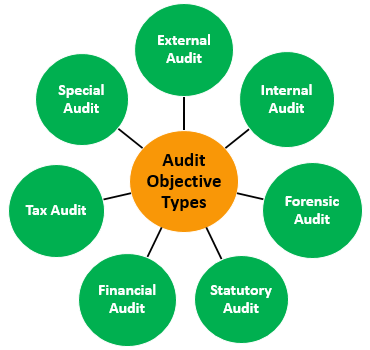

Sale/ Purchase of Fixed Assets, Sale Proceeds of the Assets Held as Investments, Rental Income, residential or commercial property, Interest income and Reimbursement of expenses as receipt.What is the Objective of Tax Audit?

One of the main objectives of tax audit is to derive a report as per the requirements of form no. 3CA/3CB and 3CD. Apart from reporting requirements of the above forms a proper tax audit for tax purposes will ensure that the accounts book and records are properly maintained as they truly reflect the income of the tax payer and appropriate claim for deductions in his overall tax made by him/her. Such tax audits would also in the review of fraud activities. It can also facilitate administration of the laws of tax audit by proper presentation of the involved accounts right before any income tax authorities and also considerably save the time and energy of the officer assessing in carrying out the routine procedure of verification.

One of the main objectives of tax audit is to derive a report as per the requirements of form no. 3CA/3CB and 3CD. Apart from reporting requirements of the above forms a proper tax audit for tax purposes will ensure that the accounts book and records are properly maintained as they truly reflect the income of the tax payer and appropriate claim for deductions in his overall tax made by him/her. Such tax audits would also in the review of fraud activities. It can also facilitate administration of the laws of tax audit by proper presentation of the involved accounts right before any income tax authorities and also considerably save the time and energy of the officer assessing in carrying out the routine procedure of verification.

In India, annual audit seems time consuming process and expensive process to businessmen. Tax audit firms in India can verify performance of the business with industry standards.

For example if your business is setup in Delhi, then tax audit firm in Delhi can review your financials and they can also recommend ways to improve.

Tax audit is required to be conduct by every eligible assesses. It is compulsory under the Income Tax Act. Tax audit has to be conducted by the tax consultants in India (Chartered accountant only.)

How Many Types of Tax Audit are there?

There are four types of tax audits:-

There are four types of tax audits:-

- The first type of audit is correspondence audit, which is the simplest of all types of tax auditsand involves an IRS to send letter to you requesting information specific to certain area of your tax return. Here IRS may have questions regarding some expense and might request you to send them receipts to provide evidence for your dedication.

- The second type of tax auditis office audit, here an auditor will have way more questions than in a simple letter about your return, generally will be more detailed and will probably take a day, and if IRS requires, they will give you more time to collect and send in necessary information.

- The third type is a field audit which is more comprehensive than office audit. Here IRS visits the tax payer at their house or their place of business/work. They may demand to see other things, they will not be limited to a particular item.

- The fourth type of tax audit is (TCMP) tax payer compliance measurement program. The main purpose of this tax audit is to get an update of data for IRS DIF scores which are developed from the analysis of a larger group involving up to fifty thousand randomly picked returns conducted every few years.

What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex