Company Registration in Thailand

Company Registration in Thailand

What is Company Registration in Thailand?

Thailand is economically progressing country. There is presence of sufficient infrastructure and an efficient workforce with the support from the government.For setting up business in Thailand following are the different Business Structures and necessary steps that need to be taken.

Types of Business Structures

- Partnership

- Limited Companies

- Private Limited Companies

- Public Limited Companies

- Joint Venture

- Representative Office

Partnership

In Thailand, there are three general types of partnerships:- Unregistered Ordinary Partnerships;

- Registered Ordinary Partnerships;

- Limited Partnerships.

Limited Companies

Here are the following types of limited companies:- Private or closely held companies which is governed by the Civil and Commercial Code and

- Public companies which is governed by the Public Company Act.

Private Limited Companies

In Thailand, Private Limited Companies have characteristics which are similar to Western corporations. Under this type of company, formation process includes registration of a constitutive document such as Memorandum of Association which is Articles of Incorporation and Articles of Association which is also referred as By-laws. There is a requirement of minimum seven shareholders at all times. This type of company may be wholly owned by aliens. Aliens participation is generally allowed up to maximum 49 percent in case of those activities which are reserved for Thai nationalsPublic Limited Companies

In Thailand, Public Limited Companies are subject to compliance with the prospectus, approval, and other requirements, offer shares, debentures, and warrants to the public.They may apply to list their securities on the Stock Exchange of Thailand (SET). For the purpose of formation and registration of the memorandum of association minimum 15 promoters are required. There is a requirement for promoters that they must hold their shares for a minimum of two years before they can be transferred. Board of Directors must have minimum five members and at least half of them Thai nationals.Joint Venture

Joint venture is described as a group of persons entering into an agreement in order to carry on a business together. Under the Civil and Commercial Code, Joint Venture has not yet been recognized as a legal entity. However under the Revenue Code, it classifies it as a single entity and income is subject to corporate taxation.Representative Office

Representative office is limited to engaging in non-profit activities. Under this, at least one of the following purposes would need to be sought for the purposes of limited “non-trading” activities:- Business is related to search for the source of goods or services in Thailand for the headquarters overseas

- It is related to check the quality and quantity of the product ordered by the headquarters overseas

- Give advice to the headquarters regarding the goods to order

- Information supply to the customers in Thailand of the headquarters’ products

- Reporting of the economic movement in Thailand to the headquarters

INCORPORATION PROCESS

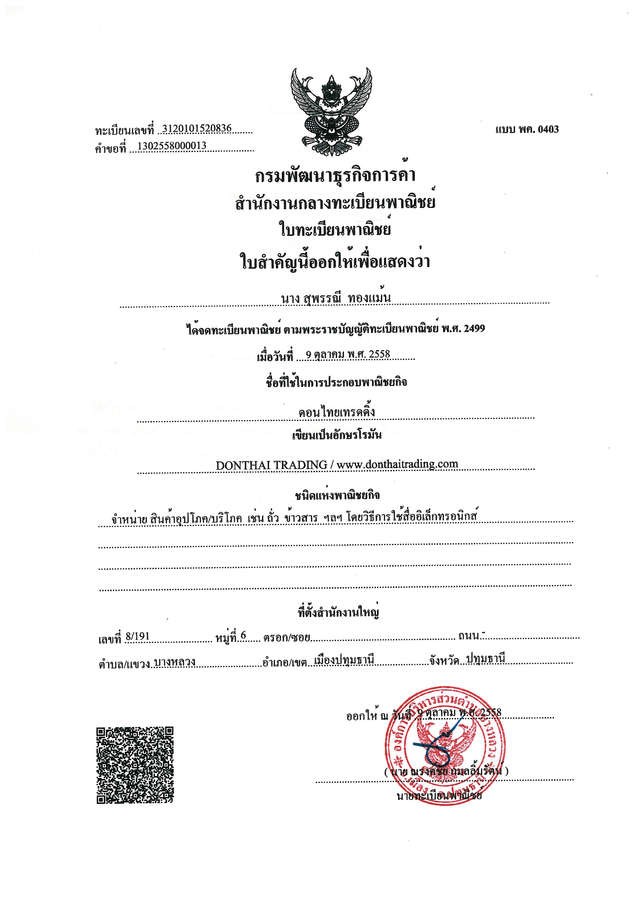

Step 1: Name Reservation Proposed name must not be the same or similar to that of other companies. The name reservation guidelines should be observed of the Business Development Office in the Ministry of Commerce. Approved name will be valid for 30 days. No extension is allowed.

Memorandum of Association must include the successfully reserved name of the company and this Memorandum of Association is required to be filed with the Business Development Office. Memorandum of Association will also mention where the company will be located, business objectives and capital to be registered with the names of the seven promoters.

It must be noted that capital information must include the number of shares and the par value. Authorized capital, although partly paid, must all be issued.

Under this, there are no minimum capital requirements, but the amount of the capital should be adequate enough for the intended business operation.

Step 3: Statutory Meeting After the above-mentioned steps, a statutory meeting is convened in which the articles of incorporation and bylaws are approved and the Board of Directors is elected and an auditor appointed. Under this, minimum 25 percent of the par value of each subscribed share must be paid. Step 4: Registration After this, there is a requirement of submitting an application by the directors to establish the company within the period of three months from the date of the Statutory Meeting.

Every business liable for income tax must obtain a tax I.D. card and number within 60 days of incorporation from the Revenue Department.

Each business earning more than 600,000 baht per annum must register for VAT when they reach the limit 600,000 baht within 30 days.

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex