Section 8 Annual compliance services

Package Inclusions –

Section 8 Annual compliance services

Annual Compliances For Section 8 Company

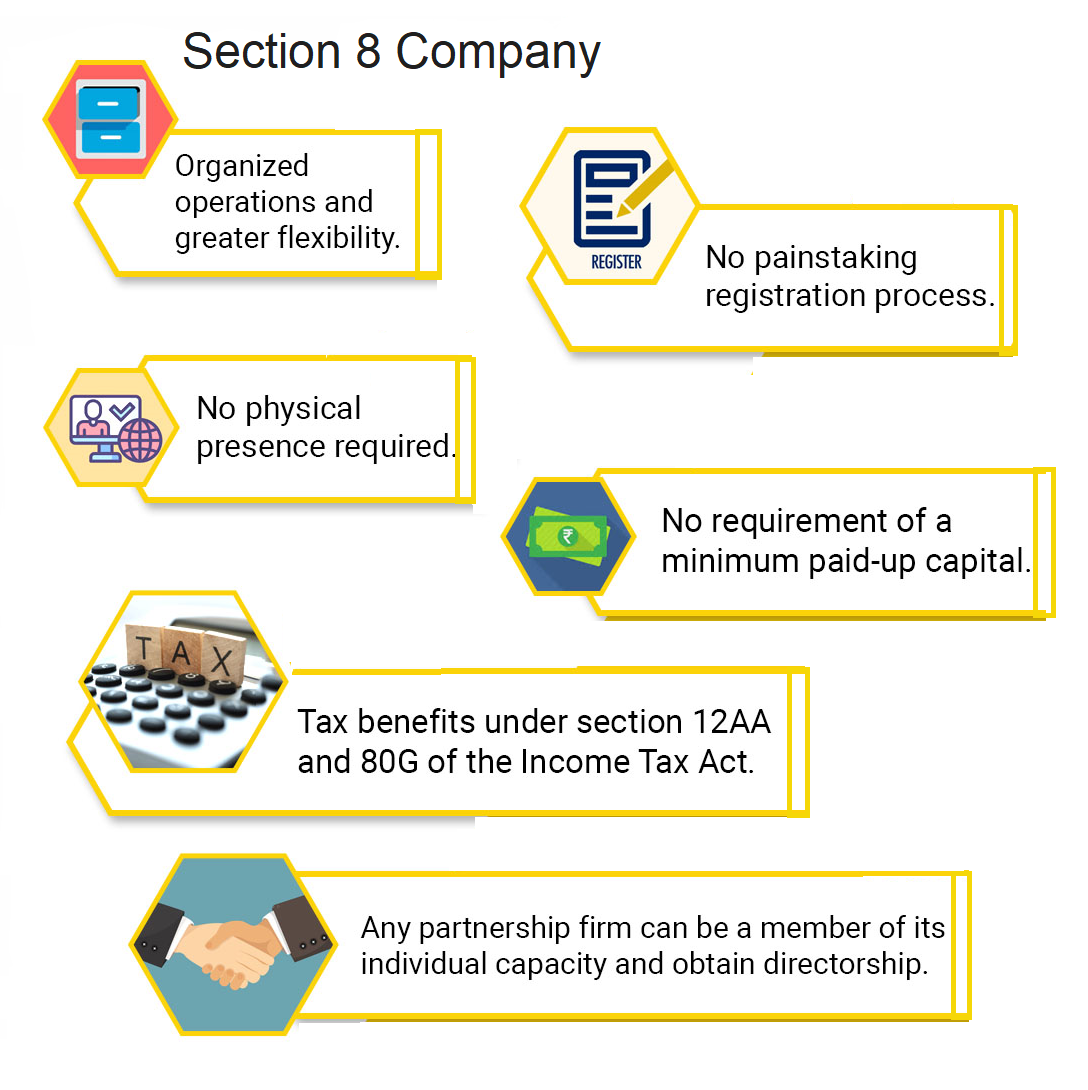

A Section 8 Company is an NGO & one of the forms of companies mentioned in The Companies Act 2013.Like every company registered under this act, Section 8 Company is required to file Compliances as prescribed in the Act.A Section 8 Company is registered for promoting sports, art, science, religion, charitable activities, etc. These companies are in obligation to file annual and event-based (one-time) compliances with The Ministry of Corporate Affairs.

Benefits of Filing Compliances

Avoid Penalties: Non-filing of compliances can attract penalties and fines for the company.Building Trust: A company filing compliance and disclosing financial information on time is considered as trustful in the eyes of suppliers, vendors, and customers.

Transparency of Operations: Filing of compliances reveals the actual situation prevailing in company operations. Filing of compliances such as financial returns can reveal about the financial health of the company.

Avoid any Legal Issues: Non-filing of compliances can give rise to legal consequences such as notice from The Ministry of Corporate Affairs. Therefore one should file compliances on time to avoid any legal troubles.

Credibility: It is easier for a company to get financial aid and market credit in case the compliances are timely filed than a company whose compliances are not appropriate.

List of Annual Compliances for Section 8 Company

Annual compliances are the compliances that are obligatory to be filed at regular intervals. These are periodical in nature and constitute a liability for the company to file.The list of annual compliance for a Section 8 Company is as follows.

Appointment of Auditor: Every Section 8 Company needs to appoint an auditor to take care of books of accounts for the company. Appointment of Auditor is must for every Section 8 Company.

Maintenance of Books of Accounts: Every Section 8 Company is expected to maintain its books of accounts periodically. This includes all the transactions related to income, expense, and donations.

Maintenance of Statutory Registers: It is mandatory for the section company to maintain statutory registers. This will provide an overview of the working structure of the company.

Convene Statutory Meetings: Section 8 Companies are under obligation to convene a meeting of the board of directors and meeting of shareholders.

Preparation of Financial Statements: Section 8 Company needs to prepare its financial statements. Financial statements are a record of financial transaction that occurred in the company.

Income Tax Returns: Every Section 8 Company is under obligation to file income tax returns by 30th September of the following financial year.

Financial Statement Returns Filing (AOC-4): It is mandatory for a Section 8 Company to file AOC-4 along with supporting documents. This return comprises details of the financial statements of the company. This is filed within 30 days of the date of annual general meeting.

Annual Return Filing (MGT-7 -ROC Annual Returns): The Section 8 Company will file its annual return with the Ministry of Corporate Affairs through form MGT -7.

One-Time Compliances for Section 8 Company

One-time or event-based compliances are those which are filed only on the occurrences of the concerned event. These are non-repetitive and are not needed to be filed periodically.

One-time or event-based compliances are those which are filed only on the occurrences of the concerned event. These are non-repetitive and are not needed to be filed periodically.

The obligation to file such compliance occurs because of the happening of a specific event. The list of event-based or one-time compliances is as follows:-

- Receipt of share application money.

- For Allotment of shares.

- Transfer of shares.

- In Appointment/Resignation of directors.

- In Appointment /Resignation of Managing Director/ Whole Time Director.

- Executing agreement with related parties.

- Any Change in the Bank signatories.

- Any Change in the statutory auditor.

- Additional Compliances- Registration for 80G and 12AA(Not Mandatory)

Due Dates for Section 8 Company Compliances

A Section 8 Company should avoid penalties and fines by filing compliances on time. Below are the due dates for filing of compliances for a Section 8 Company.| COMPLIANCE | DUE DATE |

| AGM (Annual General Meeting) | 30th September |

| AOC-4 | Within 30 days of AGM |

| MGT-7 | Within 60 days of AGM |

| Income Tax Return | 30th September |

Penalties for Non-Filing of Compliance

Every Section 8 Company should file compliances on time and with necessary records. Failure to do the same can attract heavy penalties and fines.What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex