Cash flow Management

Cash flow Management

What is Cash Flow Management?

Cash is considered to be the most liquid of assets and is considered to be most eminent for growth and investment. Therefore, for an organization it is most important to manage the activities which provides cash in effectively manner. The cash flow forecasting and management helps in interminable operations and transactions of the business. It thus enhances the comparability of the cash dealings in an organization and thereby eliminates the effects of accounting treatments for the same transactions and events.

PNJ Group helps in reviewing all the expressions of cash flow and offers best services for –

- Trade receivables

- Accounts Payables

- Sound Inventory Management

- Assets Planning

- Financing & Loan Management

Why is working capital management crucial to a company?

For an organization to grow, the goal is to have an effective working capital management which helps in ensuring the firm's continuity and it enables in maturing both short term debt as well as upcoming operational expenses. The management involves managing the inventories, accounts receivables and payables and also cash.The activities performed by PNJ Group in contemplating working capital management: -

- Reviewing the functions that are necessary for organization and managing the team goals and tasks.

- Scrutinizing the receivables and payables cycles.

- Setting benchmarks and escalation of processes.

- Identification of scope of areas to improve cash flow cycles

- Conferring better payment and collection terms.

Why Cost Management Is important for Every business?

The major challenge nowadays is to manage the cost of business. Therefore, cost management is required in an organization as it is a process of planning and controlling the budget of a business. It is a form of management accounting which allows a business to predict impending expenditures to help reduce the chances of going over budget. Thus, it is a planning, estimating, budgeting, financing, funding, managing and controlling costs so that the tasks can be completed within the approved tenure and budget. This helps in ensuring competitiveness in long run.Activities performed by PNJ Group shall include.

- Analyzing of business objectives

- Establishing budget costs, reports, preparation of charts etc.

- Evaluating cost savings, excessive costs, efficiency etc.

- Comparison of actual cost and standard costs.

- Identification of scope of areas to improve cash flow cycles.

- Reviewing the cost structure

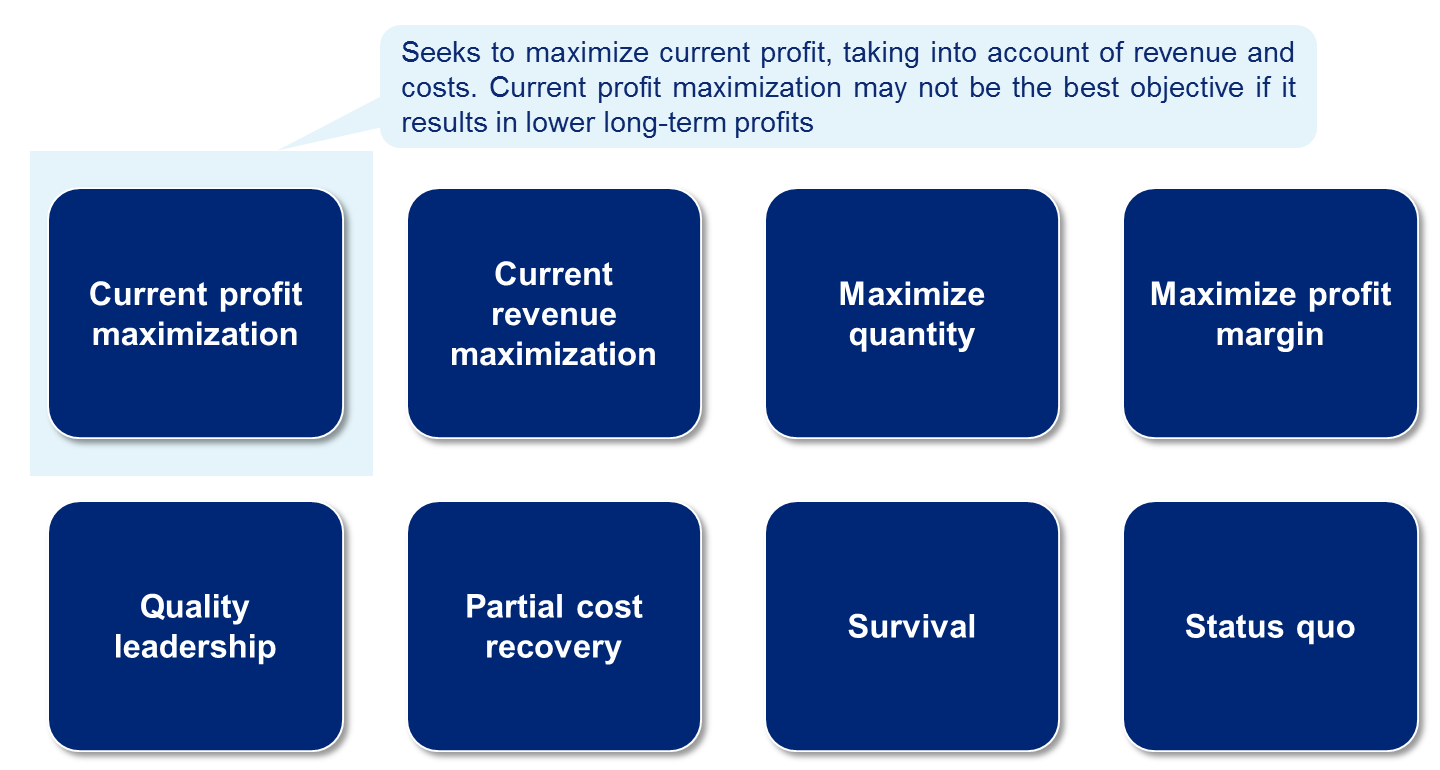

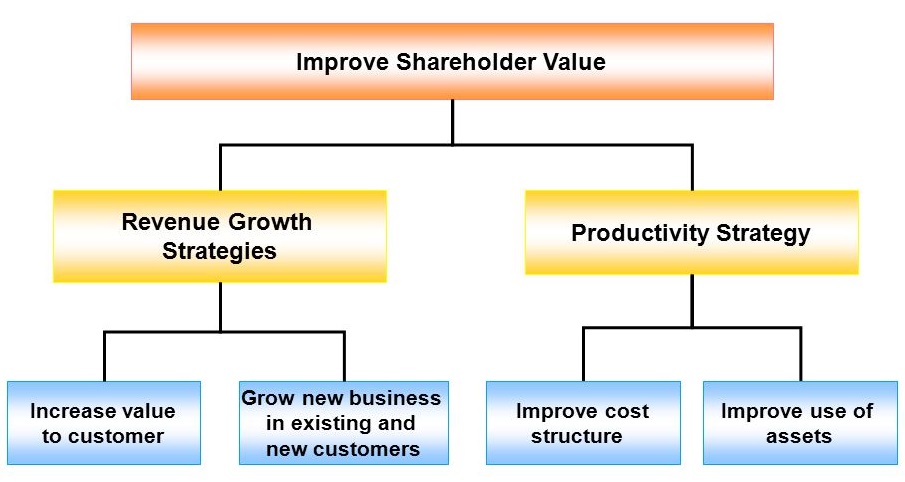

What is Profit Maximization Strategies? How to Make Your Business More Profitable

PNJ Group helps in determining and deriving even the smallest opportunities of saving costs and maximizing profits. The techniques involved shall be.

- Revenue growth Plan

- Optimization of Operating Expenses

- Process Outsourcing strategy

- Pricing strategy

- Business Trend analysis

- Financial analysis

- Systematic controls

- Improving the business efficiency.

What We Offer

Packages & Pricing

/month

6499

Starter Package

Basic

/month

10000

Starter Package

Standard

/month

19999

Starter Package

premium

FAQs For Private Limited Company Registration

The name should be unique, catchy and it must have a related meaning to you. the name of Company should also relate business Activity of the Company, however, any name may be prefer for register of a Private Limited Company subject to propose name has not already been taken by someone else. It may note that the name of the Company must also be legal as per the provisions of the Companies Act, 2013 and rules made thereunder.

Yes, It is mandatory to have at least two Directors and two members (both can be same) to register Private Limited Company in India. One Director must be resident of India.

It is not entirely correct, although there is no government fee to register a Private Company but there is always required to pay stamp duty to register a Company in India which vary from state to state.

Director identification number (DIN) is unique identification number allotted by registrar of Companies (ROC) to the person willing to be Director of a Company. Digital Signature Certificate (DSC) is a digital sign which are required to signed forms to be filed with MCA or ROC.

No, you are not required to have a proper office since a Company can be register at your residential address, it only required an address proof like utility bill, gas bill, telephone bill or water bill.

Kindly call us or fill the contact us form with your basic details or talk to our executive through online chat option.

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex