Legal Process Outsourcing

Legal Process Outsourcing

What is Legal Process Outsourcing?

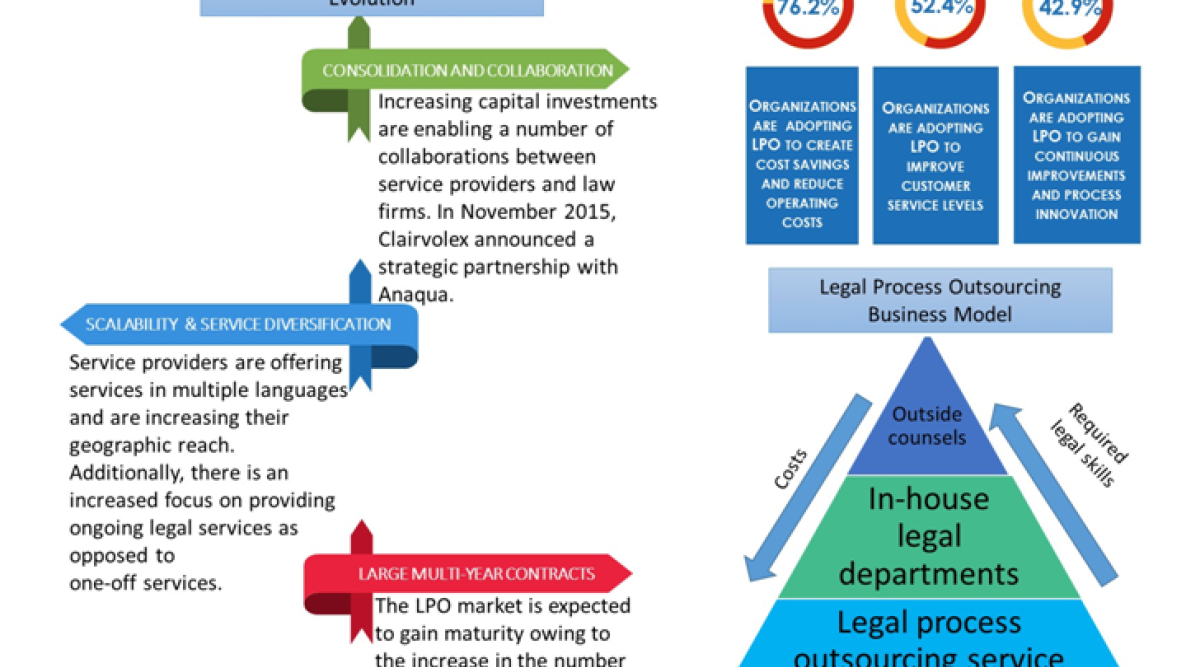

Legal Process Outsourcing (popularly known as LPO) is a practice in which a law firm or corporation obtains legal services from an external law firm or a legal process outsourcing provider.

Usually, corporate houses situated in the countries of USA, UK and Europe outsource their legal work to countries that are less expensive since the lawyers in these countries are quite expensive. By outsourcing the legal work, these corporates save huge costs that could have been spent on legal work.

India is one of the most sought-after destinations for outsourcing legal work. The LPO sector is growing enormously in India, and many investors desire for entering into this sector.

Why India for Legal Process Outsourcing?

There are many reasons why leading countries choose India for outsourcing legal work:- Availability of Legal professionals

- Good knowledge of English language

- Exposure to foreign laws

- Supports regional assignments

- Reduction in costs

- Superior IT Infrastructure and Government facilitated schemes for the sector

- 24*7 staffing

- Availability of staff with foreign qualification

Pricing Models used by LPOs

.jpg)

- Fixed rate:

- Variable Pricing:

- Pay per Unit:

- Cost plus Profit:

- Profit and Risk Sharing:

Measuring Outsourcing cost

It is vital for the company to see as to whether the outsourcing of legal work will be profitable for it or not. It can check the same via following steps:

It is vital for the company to see as to whether the outsourcing of legal work will be profitable for it or not. It can check the same via following steps:

- Analysis of outsourcing costs:

- Return on Investment:

- Evaluation of savings:

What We Offer

Packages & Pricing

6499

Basic

10000

Standard

19999

premium

FAQs For Private Limited Company Registration

LicenseHub - Copyright 2023. All rights reserved.

- Designed By-WebsApex